Buyer personas are an important part of a financial advisor marketing plan. A buyer persona is a fictional representation of your firm’s ideal client. Personas can help you tailor your marketing to develop effective campaigns designed to convert those types of clients. Let’s look at how to create buyer personas based on the types of clients you’re hoping to attract.

Add new clients and AUM at your desired pace with SmartAsset’s Advisor Marketing Platform. Sign up for a free demo today.

What to Include in Buyer Personas

Buyer personas are most effective and useful when they’re fully fleshed out. The more detail you can add, the more accurate the resulting persona is likely to be. That’s invaluable for developing targeted marketing campaigns.

To create a buyer persona, start with these details:

- Buyer name

- Age

- Occupation and employment status

- Net worth

- Investment style

- Risk tolerance

- Marital status

- Number of dependents and their ages, if applicable

- Geographic location

- Financial needs/goals

- Interests/passions

- Values and beliefs

- Non-financial goals/concerns

- Preferred social media platforms

- Level of financial knowledge/expertise

Every piece of information you include in your persona should reflect who your ideal client is. Keep in mind, it may not perfectly embody your current book of business.

That distinction is important if you’re working on niching down while scaling up. As you grow, it makes sense to invest your time and resources into acquiring not just any clients, but the clients you most want to serve.

Client Acquisition Simplified: For RIAs

- Ideal for RIAs looking to scale.

- Validated referrals to help build your pipeline efficiently.

- Save time + optimize your close rate with high-touch, pre-built campaigns.

CFP®, CEO

Joe Anderson

Pure Financial Advisors

We have seen a remarkable return on investment and comparatively low client acquisition costs even as we’ve multiplied our spend over the years.

Pure Financial Advisors reports $1B in new AUM from SmartAsset investor referrals.

How to Develop Buyer Personas as a Financial Advisor

Now that you know what your buyer persona should cover, it’s time to build one. Note that you may need to create multiple buyer personas if you work with a variety of clients.

Here’s how to develop your first persona, step by step:

- Create a basic profile. Start by giving your ideal client a name. If you want to bring them to life even further, consider adding a stock photo headshot to their profile. Fill in the basics first, including their name, age, employment status, income and marital status. Then add in more details about their investments and risk tolerance.

- Outline their concerns/needs. What does your ideal client struggle with? Which financial concerns weigh most heavily? As you build your persona, list every possible scenario your ideal client may need help with.

- Define their goals. Once you identify your ideal client’s biggest pain points, consider what they want to achieve financially. Be specific. For instance, instead of saying your ideal client wants to invest for a secure retirement, you might say that they want to build a portfolio that generates a 10% return annually so they can retire at 62 with $1.5 million saved. That’s a tangible, trackable goal that you can build a workable plan around.

- Assess their values and beliefs about money. Behavioral finance attempts to explain the psychology behind people’s actions or beliefs surrounding money. As you develop buyer personas, ask yourself what your ideal client values most where their finances are concerned. Consider the types of experiences they may have had with money in childhood and how that may have shaped their financial attitudes as adults.

- Identify their why. Why does your ideal client need an advisor’s help? And what type of advisor experience are they looking for? Answering these questions can help you shape the language you use in your marketing so that your messaging speaks directly to their needs.

- Consider objections. No buyer persona is complete without an understanding of the objections your ideal client is likely to raise. For example, they might say they’re not comfortable discussing their finances with a stranger, or they already have a financial advisor. Identifying potential objections can help you prepare arguments to counter them should they arise.

- Add some expectations. An effective way to wrap up a buyer persona is to ask yourself what they expect from an advisor-client relationship. For instance, are they the type of client who prefers to be hands-on in the planning process, or will they leave the heavy lifting entirely to you? How do they prefer to communicate? What type of technology tools might they be interested in having access to as they manage their financial plans? All of these questions can help you shape your marketing so that you’re speaking not only to their needs/goals, but their expectations, as well.

Build a Better RIA

Drive growth with automation, not headcount using the all-in-one advisor marketing platform.

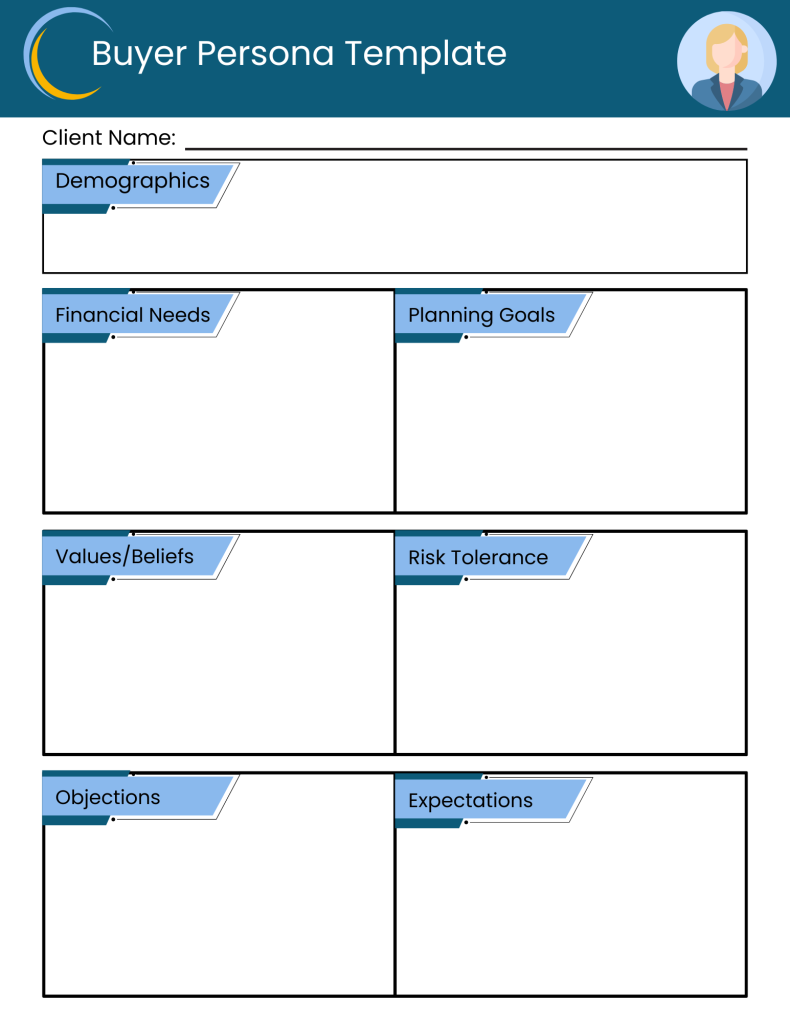

Financial Advisor Buyer Persona Template

Templates can simplify your business planning. You can use this financial advisor buyer persona template as inspiration for creating your own.

Frequently Asked Questions (FAQs)

What Are Buyer Personas?

Buyer or client personas are idealized representations of your ideal client. A buyer persona can offer insight into how your ideal client thinks and makes decisions, as well as what they need or expect from you as a financial advisor.

How Do Personas Help with Advisor Marketing?

Marketing without an ideal client in mind is like sailing without a compass — you need a set destination in mind to guide your decisions. Buyer personas allow advisors to develop marketing plans that reflect the exact person or persons they most want to serve. It ensures that you’re sending the right message to the right prospects in the right places.

Do Advisors Need an Ideal Client?

You don’t need to have an ideal client in mind or even a niche to be a financial advisor, but both of those things are helpful to have if you’re focused on growth. Client acquisition is less of a guessing game when you know who you want to target, how you can help them, and what kind of marketing strategies they’ll likely respond to most favorably.

Bottom Line

Buyer personas can play an important part in your advisor marketing plan. At the end of the day, the goal is to attract the kinds of clients you’re best suited and equipped to serve. If you have yet to develop a buyer persona for your firm, the strategies shared here can help you get started.

Tips for Growing Your Advisory Business

- How big is your firm’s digital footprint? Size matters for marketing, and without a solid strategy, it’s easy to get lost in the crowd. If you’re looking for a way to complement your current efforts, you might consider partnering with an advisor marketing platform. SmartAsset AMP (Advisor Marketing Platform) is a holistic marketing service financial advisors can use for client lead generation and automated marketing. Sign up for a free demo to explore how SmartAsset AMP can help you expand your practice’s marketing operation. Get started today.

- If you’re struggling to choose a niche, you may find it helpful to do a little self-assessment. For example, ask yourself what areas of financial planning you’re most qualified to help with. Consider which problems you’re uniquely positioned to solve and what competitors are doing to address those needs. Niching down can help you scale up if you’re attracting clients that other advisors are overlooking.

Photo credit: ©iStock.com/VioletaStoimenova, ©iStock.com/FG Trade Latin, ©iStock.com/ijeab