Early in his career as a financial advisor, Robert Gilliland relied on traditional strategies for attracting new clients like hosting seminars and treating prospects to expensive dinners.

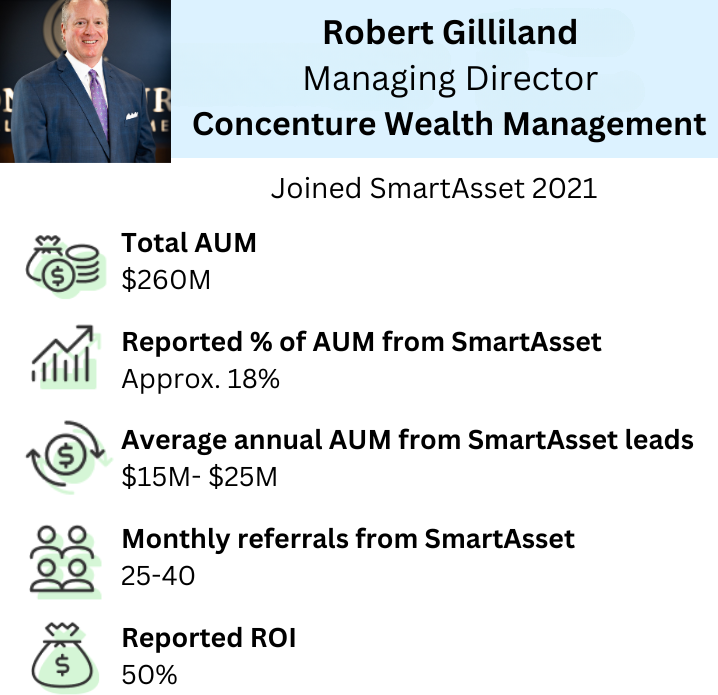

But Gilliland’s process for acquiring new clients has evolved significantly, thanks in part to SmartAsset AMP. Gilliland opened Concenture Wealth Management in Houston in 2020 and has since added an estimated $50 million reported in assets under management (AUM) using SmartAsset over three years. The platform’s suite of marketing tools, which include automated emails and text messages, have largely replaced the more traditional lead generation approaches that Gilliland once used.

But success using SmartAsset AMP isn’t guaranteed, he said in a recent Advisor Success Series interview with SmartAsset founder and CEO Michael Carvin. Instead, it often hinges on the advisor’s willingness to systematically work the referrals they receive. This often requires equal parts persistence and patience, even if an initial conversation with a lead doesn’t produce a new client.

“You have to reach out and contact every single person, and you have to do it multiple times, multiple ways. You have to meet that client where they are, right? You can’t force them into it. You have to meet them in the manner that they want to.”

Learn more about generating leads with the SmartAsset AMP platform.

Interview Transcript

Michael Carvin: Welcome to SmartAsset’s Advisor Success Series. I am Michael Carvin. I am the founder and CEO of SmartAsset. I’m joined today by Robert Gilliland. Excited to have you on the program, Robert.

Robert Gilliland: Michael, thank you for having me. It’s pretty exciting.

Michael Carvin: Well, let’s start by just hearing a little bit about yourself, your practice, how you got into wealth management.

Robert Gilliland: The way I got into wealth management is, in college I was sitting in my very first finance class. The professor said – at that time they were called brokers – a broker, five years out, makes $100,000 a year. At that time, the top 1% of this country made $100,000. I decided I was going to become a financial advisor. And the rest, they say, is history.

So I’ve basically been doing this for, going on, about 25 years. After graduating from college, I came straight to Houston to become a financial advisor with a major wirehouse here in Houston. I spent 20-plus years of that career – I guess about 21 – at a major wirehouse. I was in leadership at that, as well as managing my team.

In February of 2020, which tells you my timing was impeccable, we left and became an independent financial advisor, and we founded Concenture Wealth Management.

What was great about that was that within six weeks, 96% of our clients moved, so we had a process down. We got our clients moved. Then, I guess probably about a year later, after we had everyone and everything, and got our sea legs under us – if you will – we found SmartAsset and started growing and really haven’t looked back. Our team right now consists of a total of seven, including myself. I’ve got a CIO who used to work for BlackRock. I’ve got two other financial advisors, an associate advisor, and then our assistant, as well as a marketing associate to help us continue to grow and market the right way.

Michael Carvin: Look, any time you’re starting your own firm, there are a lot of challenges. But starting your own firm in February 2020 – anything to share about getting live right before a global pandemic?

Robert Gilliland: Yeah, just be prepared to work. I mean, actually it ended up working out for us because all the major firms completely shut down. Here in Texas, the governor said that if you are a finance company, you were considered systemically important. So we claimed that we were a finance company, and we worked every day. I told everyone they could work from home or come into the office. What was amazing is the team said, “All right, let’s go. We’ll be in the office. That’s the best way.” We were very fortunate. It’s a lot of work, but once you get it done, it feels great.

Michael Carvin: Good for you guys. And how did you grow your book of business before you started your own firm? You obviously already had a number of clients that came with you. How did you get started?

Robert Gilliland: Yeah, I’ve done everything, right? I mean, there’s a finite number of things that you can do. There’s no new, inventive way. You can get referrals – actively get referrals. You can network, you can do seminars, you can cold call, you can cold mail, you can knock on doors. Which I’ve never done.

Basically, the way that I grew my practice was back in the early 90s when it was easy, you could mail out 2,000 invitations and have 150 buying units show up to a series of seminars. You’d buy them a dinner and you would end up with 15 to 20 appointments, and then you’d have some close ratio off of that. Right? It was relatively easy, but I think times have changed. The way I grew my business was really through referrals, seminars and networking.

Michael Carvin: It sounds like the seminar strategy is less effective today than it was when you started with it. What do you think has changed?

Robert Gilliland: Well, I think that people get bombarded by it. It ends up being extremely expensive because you have to have nice dinners and all of this. And there’s become a segment of the population when seminars are no longer new, they think that they’re going to a sales pitch. There’s a huge segment of that group that shows up just for the meal because you’re having it at a nice steakhouse or a nice restaurant, right? And they’re showing up for the meal with zero intention of actually having a conversation with you.

So, I think it’s changing. Too many people have them into sales [pitches] as opposed to informational things, and people feel like they’re being sold the second they walk in.

Michael Carvin: Do you still do that anymore?

Robert Gilliland: No. I thought about doing it, but then, in all reality, I found SmartAsset. At the same budget, I could do better.

Michael Carvin: Tell us a little bit more about your practice. You have seven team members. Can you tell us a little about your AUM and the kind of client you target?

Robert Gilliland: My office being here in Houston, Texas, we’re right in the middle of the energy corridor. Most of those people who work for these energy companies want help with their 401(k)s. They want to know how to create a retirement income plan.

Our typical client has about two and a half million dollars, and they’re either at or near retirement. Our main focus is in retirement planning. But what we’re really, really, really good at is helping people move from an accumulation phase into an income phase. How do you create that income stream for them so they don’t have to worry about what happens with the market on a day-to-day.

We do that without utilizing some of the traditional ways, though sometimes we will utilize annuities and things like that. But there are other ways to do that. And when you go through it, it really gives them peace of mind because the way that we focus is on the outcomes that our clients are looking for and ensuring we are able to reach those outcomes with a high degree of certainty.

Michael Carvin: That makes a lot of sense. And so does that mean that you go through a financial planning exercise before you onboard a client?

Robert Gilliland: One hundred percent of the time. Everything starts with the plan. Everything starts with finding out what’s important to the client – finding out the things that are “must-haves,” “like-to-haves” and “would-be-nice-to-haves,” right? Going through and assigning a probability of success using Monte Carlo simulators to determine our probabilities of success and then working with our clients as a partner to help them achieve the goals that they want. The beautiful part about that is we can go through and keep score every step of the way. So every year, they know exactly where they are. “Yep, we can buy that second home, or, here we can go on these vacations, or we can help the grandkids out with college.” It gives our clients a lot of peace of mind, starting with that plan.

Michael Carvin: It makes a lot of sense. You’ve probably got people that are really interested in understanding how they go from accumulation to a sound income plan. Are you also offering tax strategies, estate planning – other services that clients might want?

Robert Gilliland: Yeah, we obviously do tax strategies a lot of, because we focus so much on retirement and retirement plans. There’s obviously a window of opportunity here with regard to Roth conversions. But with our clients who have maybe sold their business or have significant assets on the taxable side, you would be almost committing malpractice in this type of environment if you weren’t paying attention to the tax-efficient management of the portfolio. So, we help our clients out, but we don’t do taxes and we also don’t do estate planning. We don’t have an attorney or a CPA on staff, but we work very closely with those CPAs and attorneys and work with every single one of our clients – especially as clients are aging – on their estate planning, making sure they have the things in order and we have the most efficient transfer of assets as possible.

Michael Carvin: Did you start working with SmartAsset before you started your own firm or after? How did you come to start partnering with us?

Robert Gilliland: So what’s funny is, I was talking to a buddy of mine from my old firm actually up in Buffalo, and he told me that he had just been told he could no longer use SmartAsset. I go, “What’s SmartAsset?” and he tells me that this is what he did, and he opened up a $20 million account in the first three months and 10 other relationships. I’m like, “What’s the name of that again?” And so I reached out to SmartAsset.

I think it was 2021 – I guess it’s three years now with SmartAsset. I started off kind of slow to kind of figure things out, but then I realized it’s a numbers game. If I make this investment, I’ve got to make it work, and more is better. I got my team trained up, and that’s kind of where we are.

Michael Carvin: Yeah, that’s one of the first insights that all of our successful partners realize. It’s about getting at-bats, and the more at-bats you get, the more clients you’re going to be able to convert.

Robert Gilliland: You know, it’s funny you say that, because when I explain SmartAsset to people at other firms that I’m friends with, I tell them is that they get three people, but I don’t care, because it’s just like a batting order. After you go through the first round of the batting order, that seventh batter is going to come up, right? Or the fifth batter is going to come up. It doesn’t matter. It’s a circle. If you get a good one [lead], hey, that’s great. If you get a bad one, it doesn’t matter. The next one’s going to be a good one.

Michael Carvin: That’s exactly right. Maybe you can tell us a little bit about how your account is set up. How many referrals and leads are you getting on a monthly basis? What’s the makeup of how you’re working with us?

Robert Gilliland: So one of the things when I very first started is that I did the $500,000 to $1 million [range] for half of the leads, and then the other half over $1 million.

Michael Carvin: $250,000?

Robert Gilliland: Yeah, $250,000 to $1 million and what I realized was that I was having the same success in each one. So, for the last 18 months or so, I’ve been focused just on the million-plus [leads].

I spend, minimum of roughly $5,000. I kind of scale, in months, because I’ve been doing this I know there are months that are really good. We also at the very beginning of the year, we do what’s called surge, where we meet with every single one of our clients in the first six weeks of the year. So I scale back a little bit there. We’re still engaged and involved in getting leads and following up and doing that, but we scale back. Then we ramp it back up. I’ve spent as much as $8,000 a month for several months and as low as $3,000 every single month.

Michael Carvin: And what’s your experience been? Can you talk a little bit about, for every 100 referrals you’re getting from us, how many are you getting in touch with? How many are you setting meetings with and then how many are you trying to close?

Robert Gilliland: Yeah, so I guess basically, we get between 25 and 40 leads a month. It just kind of depends on what the spend is. This is what I’ve noticed: Making the phone calls is increasingly difficult. It goes to voicemail, or it just doesn’t get answered or it gets hung up.

In fact, I’ve got a meeting this afternoon. I’ve never even talked to this lady. She was a SmartAsset lead. She scheduled it because of the automated process that’s inside of that. It used to be that when we get a lead, we’d hit them with a phone call, we’d send the email and all of this was manual. Now we have it so that it’s all automated. We make phone calls and then I’ve got other people on my team that after the leads, after the two primary advisors have reached out enough, we kind of give it a little breathing room. Then I put my younger advisors to go to get meetings scheduled for us. We may wait, like three to four months, and they are just kind of on their list, they will give them a call and they will send them an email. What’s crazy is just this week, we scheduled another meeting with a guy who was from SmartAsset from two years ago.

The key is the way I describe SmartAsset and the leads and where it is, is that just because you get a name Joe Smith doesn’t mean Joe Smith is becoming a client. It is a full-contact sport, and you need to have a repeatable, scalable process that, luckily, can be automated to go to reach out to them and get them to come in. It does take you making phone calls. It does take you trying to get the meeting, and finding out what’s important to them. That’s kind of what our process is.

Michael Carvin: You said a couple of really important things there. One, “scalable, repeatable process.” It is competitive. You know, consumers like the fact that they have a choice. They like the fact that they can talk to multiple advisors. It actually gives them more confidence that the advisor they ultimately go with is the right one for them because they’ve spoken to a couple. So it actually lifts the overall conversion rates. That scalable repeatable process is super, super important.

And then, understanding who is going to talk to them when. It sounds like you have your primary advisor talk to them first, and then a junior advisor follows up with them a little bit later?

Robert Gilliland: Yeah. So if I just got a lead, I would be reaching out to them very shortly. I have it automated to send them a text, send them an email, but I’m going to be the one who’s going to be calling them to get inside there. If we go 90 days and we haven’t been able to make contact, then we give it a bit of a breather. That’s when it goes onto the list for the newer advisors to try to reach out.

Michael Carvin: And that’s the other thing that I think is really misunderstood about our platform. I think advisors think that if they are not able to get in touch with or close that person within the first couple of months, that that’s not a good referral, that that’s the cost of doing business, a part of the process. But one of our biggest partners closes more than half of their clients after the six-month mark.

Robert Gilliland: Wow.

Michael Carvin: They might have a meeting with them or get in touch with them before six months. But the close is not happening until six months later. So what you’re doing by picking up the phone and calling those consumers four, five, six months – it sounds like you’ve got a great one two years later – that’s really going to yield a lot of benefit for your overall conversion rates.

Robert Gilliland: Look, I’ve already bought the leads. They’re not costing me anymore, and even if out of 100, we just get five meetings or two meetings, we’re good on that.

I will tell you something I have found really, really interesting about SmartAsset. Sometimes you go to think through these lead sources and what leads you can get, you really have no idea where and what it is. My team has talked to because of SmartAsset, my team has talked to a hall of fame NBA basketball player from Houston, actually had a conversation, got a meeting set up – he ended up having to cancel but we are still in the process of following up on that and a hall of fame NFL football player from Houston led the NFL in tackles for 11 years. We’ve had conversations with people who have real money. I’ve talked to a guy who said he was going to be coming into $100 million. There’s an opportunity there. It’s not some kid out there typing in – these are real leads that generate real business and real opportunities.

Michael Carvin: Yeah, some of the stories we get to hear are amazing. We’ve had a person who said they owned an original copy of the Declaration of Independence, that was a pretty interesting one. That person had about $40 million of investable assets. We had a lottery winner – a guy who had just won $100 million and was sitting on $100 million cash – come through. You know that’s a pretty good referral to get.

So, what we’re trying to do is find your ideal consumer. For you, for your firm, we’re trying to find that consumer with $1 to $3 million of investable assets who’s approaching retirement and the biggest concern they have. This is the most common thing we see from consumers, why they’re coming to us: they’re coming to us because they’re getting close to retirement. You know, the average investable assets are just north of $1 million dollars, and they’re nervous. They’re nervous about how they’re going to manage their retirement. They need planning help.

They know that – it’s exactly what you described – they’re nearing the end of their accumulation phase, and they’re worried about how they’re going to take care of healthcare expenses. They’re worried about what they should do about real estate and how they’re going to think about taxes. They need real help and they need intelligent investment management help. That’s the sweet spot.

But when we’re going after that, we get a lot of other stuff too, which is great. It sounds like you’ve got some great professional athletes that could become clients as well. That’s really great to hear.

Robert Gilliland: Yeah, it’s exciting. If something that if you were just talking to other financial advisors, they wouldn’t necessarily believe that someone like that is actually filling out a questionnaire online or anything like that. That’s what I think I’ve been most amazed at –is that it works.

Michael Carvin: I think the bias that most people have is, they think because it’s a digital experience – it’s all online – people think it’s going to be younger people with less investable assets. And that’s just not really the case. The data is really, really compelling. The average investable assets, the category you’re in are just over $1 million, it’s an older consumer nearing retirement. It’s funny that you mentioned professional athletes because if you think about the accumulation phase – you accumulate a lot, but very quickly. So they have a lot of complexity because they’re probably going to make money over 10, 15 years, not over 30, 40 years.

Robert Gilliland: Yeah, if they’re lucky, right?

Michael Carvin: Exactly. So how do you think about ROI – the return on your investment with us? How do you know it’s working? How do you know it makes financial sense for you?

Robert Gilliland: Basically if we look at last year, where my budget was about $8,000 a month, right? So if we just took that six-month period, that’s roughly $100,000 a year. The way I’ve always viewed this business is that in the first year, I want to make 150% of what I spend. My experience with regard to SmartAsset is every year I’ve done it I’ve brought in between $15 million and $25 million worth of assets directly attributable to SmartAsset.

If you go with, say, $15 million in assets at 1% is $150,000. I made 150% of what I spent. So that’s year one. Year two, it’s all as they say in Louisiana, “lagniappe” – it’s all just a little bit extra, right? So I’ve always viewed that if I can get at least 150% on what I spend, then that’s a good investment. The thing I found really interesting, specifically around SmartAsset, is it cycles.

The first part of the year – and it’s happened every year – some of that has to do with things we’ve got going on. I get to May or June, and I’m like, “We’re not doing anything. What’s going on? We’re behind these numbers, what’s happening here?” Then the last half of the year, it all comes rushing in. Or at the end of the year, I’m like, “We’re way behind” and all of a sudden at the beginning of the year, we’ve got these assets that are coming in. It’s cyclical that it happens. It’s just a matter of trusting the process and continuing to follow through, and it will come.

I have zero question about whether or not it’s a good investment because you’re not going to hire a bank of cold callers. That’s not going to be successful. If you’re going to do a digital strategy – which, by the way, we do – if you’re going to do some sort of digital marketing, there’s not an immediate return. It’s going to take you 24 months before you really get any sort of traction. You have to get 10,000 followers before you start to see those things happen. And seminars are expensive and they take a ton of time, and you end up feeding a bunch of people for no reason. This is a way that, with that very same type of budget, you can go and do this.

And if you do like to speak in front of people, it doesn’t just stop with making a phone call and sending an email. You can take that group and do webinars. You can take that group and do targeted emails and things like that.

Any investment I make I want to make 150%. To cover my costs – 100% – and 50% profit. I guess a better way to say that. So if I spend $100,000 and bring in $15 million in assets, at a 1% velocity on that or our asset management fee on that, I will make $150,000. My profit, I guess, is 50% right there. That’s in year one. Year two, it just goes up.

Michael Carvin: That’s great math. And do you know the total amount of money you’ve raised with SmartAsset?

Robert Gilliland: Well, if we go with three years, it’s probably around $45 or $50 million.

Michael Carvin: That’s great. That’s great to hear. It sounds like we’ve become a valuable part of your business.

Robert Gilliland: Well, it is the primary way that we market. In fact, with my younger people – and clearly I have gray hair – what I realized in going through and looking at my book is that the average age of our book is about 57. The people we’re talking to fit right inside of that average age. Call that our core business, right?

But if I’m looking at the longevity of this firm, for all the people that are here and for myself, I’m looking at longevity, kind of want to drop that down a little bit, that average age. And so the things I’m thinking about is that I stay focused here on that core, and then I add additional [clients] for these younger people [advisors] to call that they’re going to connect with. So we’re in the process of doing that.

Now we’re going to have two different focuses coming in, because I do think you can focus on those younger people, too, because there is money. That 28- to 38-year-old executive, there’s a lot of things that a financial advisor can do. You can make that a profitable business. Our bread and butter and the stuff that’s fun and easy to do, and great relationships is something that we can do and we do it very, very well – helping our clients that are in retirement. But it’s also fun helping people grow to that level.

Michael Carvin: That’s great. That’s great to hear that. I’m curious, what advice do you have for advisors that are new to SmartAsset’s platform or have not seen success yet? What are some things that you think could make them more successful working with us?

Robert Gilliland: I think what they need to do is make sure they have a process. AMP is a great way to have that process, so that it’s automated. The other is to trust that process. People want to do business with people that they like. And the great thing is that because of this process in technology where it is, you can really utilize technology to help you.

Just sending a 200-word email isn’t necessarily going to do it. Shoot a personalized video: “Hey, Michael, SmartAsset connected us and thought we should talk. Below is a link to my calendar. I would love to schedule 20 minutes just to introduce us and find out how we might be a resource for you.” Send that email. You have to have this process in place and it has to be repeatable.

The other thing I would tell everyone who is thinking about or using SmartAsset is you have to give it time. One of the things when I started in the business, it was basically you had a 30-day close period, right? Technology, life, business, everything has kind of expanded that. Our close time is about 45 days from the first meeting, which may take us three weeks to get that first meeting – first meeting to close.

Knowing that the sales process has expanded – it can go as long as 90 days – be patient. Remember that it is a full-contact sport. You have to reach out and contact every single person, and you have to do it multiple times, multiple ways. You have to meet that client where they are, right? You can’t force them into it. You have to meet them in the manner that they want to.

Michael Carvin: And I’m curious. When you get that meeting, and you get in the room or on the phone or over Zoom with a prospect, what tips do you have for advisors on how to handle that first conversation? I’ve seen some advisors have a very strong sales pitch. Some advisors are in listen mode: “Tell me about you, and I’ll figure out how I can help.” What are you guys doing?

Robert Gilliland: I think the biggest thing without being too philosophical – but I think that it resonates – is you have to find out what’s most important to the client. Simon Sinek in a TED Talk and a book, says explain to people the why. Well, I think that that’s been used a lot. The reality is that, as an advisor, you have to find out their why.

So the way that we do it is we go through and we peel the onion back and find out what’s most important to them and what caused them to even click, “Yes, I want an advisor to reach out to me.” When we find that out, then what we want to do is show you solutions. We’re not trying to sell. We’re just trying to show you solutions to make sure that your goals and what you’re wanting to have happen can happen.

And then we’ll go through and build this plan. Then it’s all about them, finding out about the family, finding out their goals, finding out what they need to have happen, and then show them the solution to that. At that point, I don’t think it’s selling. I think it’s like, “Hey, you’ve got a problem, I’ve got a solution, and I heard you.” Clients want to be heard. They don’t want to be sold.

The thing is as an advisor, unless you have a process for actively getting referrals or some other sort of marketing thing, I truly think that this [SmartAsset AMP] is as easy as it can be to be able to get in touch with people.

You have to remember that it is a full-contact sport. You have to be active. It’s not passive. You have to be reaching out. But if you’re patient and work the process, then it leads to success.

End transcript.

Learn more about generating leads with the SmartAsset AMP platform.

Testimonials appearing on this site are actually received via text, audio, or video submission. The testimonials are provided by financial advisors that have ongoing business relationships with SmartAsset. They are individual experiences, reflecting the real-life experiences of those who have used our products and/or services.

The testimonials are not 100% representative of all of those who will use our products and/or services, and we make no admissions of such.

The testimonials displayed (text, audio, and/or video) are given verbatim except for correction of grammatical or typing errors. In some cases, the testimonial has been shortened in length where it has not been possible to display the whole testimonial, and where we considered, acting reasonably, that some parts of the testimonial were not relevant to our site, products, or services.

SmartAsset may extend free products, discounts, promotional support, or other indirect or direct financial incentives to these sources. These incentives may or may not influence the nature of the testimonial. In this case, compensation was provided.