It seems we always end up with a stack of paper documents lying around, even with the major shift to mobile and online banking. But how long should you keep those bank statements really? You can usually dispose of your bank statements within a year, but sometimes you may need to keep them longer for tax purposes. Before you throw out those bank statements, this is what to consider.

If you’re looking for financial advice, a financial advisor can help you manage your bank accounts while also helping you create a financial plan for your long-term goals.

How Long to Keep Bank Statements

If you’re still receive paper bank statements, you’ll generally want to keep those for about a year. Banks typically keep statements for the past year pretty accessible online, as well, but you should doublecheck with your bank how far back access goes. It may have available an online archive of statements going further back.

As for credit card statements, you only really need to check for inaccuracies before you throw them out. Be sure to compare each statement against your receipts, searching for any potential fraudulent purchases. After you have done a thorough check, you can safely dispose of your statements.

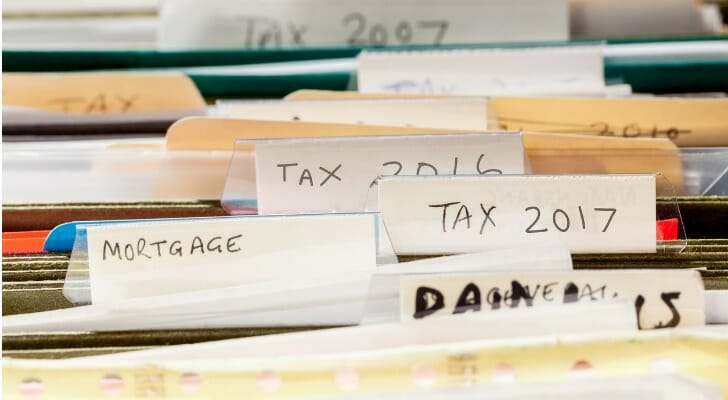

Be sure to store any statements you keep in a safe place. It helps to separate your bank statements from credit card statements, receipts, investment statements and other documents. That way, if you do need to reference certain statements in the future, you will know exactly where to find them.

Why Should I Keep My Bank Statements?

Keeping your bank and credit card statements or a year might seem like unnecessary hoarding, but there are a number of important reasons why you should keep them accessible. For one, investment and banking statements are crucial to filing your taxes correctly, as they provide proof of income. You should also save records of any business expenses, mortgage payments, tuition payments, student loans and charitable donation receipts.

Another reason to keep your bank statements is the IRS. The IRS can ask you to provide documentation to support your filings for up to seven years after you file a return.

Saving your credit card statements is helpful in the event of statement inconsistencies or if you fall victim to fraud. Producing proof of spending will help you file a credit card dispute in case there are any mistakes on your credit card statements or credit report. Without the correct documents, you may be stuck with a faulty charge on your credit.

What Happens If I Throw Out Bank Statements?

If you were to throw out your bank statements prematurely, the worst case scenario is that you could file an inaccurate tax return. You could also find yourself in a bind should you end up with an IRS audit where you need to produce these documents.

You could set yourself up for identity theft or fraud if you don’t properly dispose of your bank statements. Always shred any documents with your personal and financial information before tossing them in the bin. This will prevent fraudsters from easily collecting your information from the trash.

Digital vs. Paper Statements: Which Should You Use?

You can get bank statements in digital or paper form. Digital statements are often preferred because they offer convenience and easy access. Most banks store several years of statements online, and you can download or print them anytime. They are also searchable, which makes finding a specific transaction or date much easier than flipping through paper records.

Paper statements may still be a better fit for those who prefer a physical copy or don’t use online banking. Some people find it easier to organize and review paper records, especially for budgeting or tax preparation. Paper also doesn’t require a device or internet access to view.

Security is important for both options. Digital statements should be saved in a secure, encrypted folder on your computer or cloud storage. They should not be shared by email or stored on public devices.

Paper statements should also be treated with care and kept in a locked drawer or file cabinet. Always shred paper documents before throwing them away to prevent identity theft.

Choosing digital over paper helps reduce clutter and waste. Going paperless means fewer documents to file and less impact on the environment. If you are comfortable with online tools, switching to digital statements can simplify your recordkeeping and save space.

Bottom Line

It’s recommended that you keep your bank statements for at least a year. This ensures you can file your next tax return with the most accurate information. However, there is no harm in keeping this information longer if you think this information may be useful in the future, such as for a tax audit. Luckily, nowadays much of this information is online so you do not necessarily have to deal with a growing pile of papers.

Ask a financial advisor how to organize your financial documents to protect your bank accounts and prevent identity fraud going forward.

Tips for Banking Responsibly

- Organization, including keeping track of your bank statements, is an important part of managing your finances. But as you keep a paper trail and verify the accuracy of your statements, it can be advantageous to have expert advocate in your corner. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- It’s great to bank at a branch near you, but you can probably find higher rates online. Regardless of where you live, here are some of the best high-interest savings accounts.

Photocredit: ©iStock.com/Rawpixel, ©iStock.com/BackyardProduction, ©iStock.com/mapodile