Writing checks isn’t as common as it used to be. Many of us rely on our credit cards, direct debit and cash to make the payments in our lives. For some people, a monthly rent check is the only check they ever write. But whether you’re setting up direct deposit, online bill pay or a money transfer account, you’ll still need to know where to find your account number and your bank’s routing number.

If you need help setting and reaching savings or investing goals, a financial advisor can help you create a plan.

What Is a Routing Number on a Check?

Think of the routing number on a check as a bank’s address. It’s a unique 9-digit number that indicates the financial institution the account belongs to so whomever processes the check knows where the funds are supposed to be deposited or withdrawn. So an account number must be used with a routing number to complete a transaction.

What Is an Account Number on a Check?

The account number is longer than the routing number and preceded by several leading zeroes. The routing number indicates the bank, while the account number identifies which account the bank will use to process the transaction. It’s worth noting that banks follow account numbers, not account holders, so if you have multiple accounts at the same bank you must be clear about which specific account you’re working from.

Routing Number vs. Account Number: Key Differences

A routing number, or bank transit number, is a nine-digit number that helps banking or other financial institutions know where a financial document, such as a check, originated from. It identifies the bank that money will typically be flowing in or out of when a transaction is complete.

An account number is a unique number that identifies an individual or legal entity’s bank account. Every account number is unique at the financial institution, or routing number, that it is associated with. This ensures that every financial account in the world has a unique combination of routing and account numbers to always be correctly identified.

How to Find Your Account Number on a Check

If you have a personal or business check in front of you, you’re looking at your account number even if you don’t know it. So where is the account number on a check?

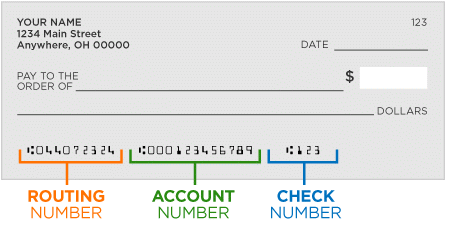

Your account number is the long string of numbers that’s in the middle of the bottom of your check. Check out our graphic below if you’re in doubt. The account number on a check could be in a different spot depending on your bank, but chances are the account number on your check will be where it is in our diagram.

You might need to find the checking account number on your check if someone has asked you for your account number because that person wants to give you some money. Or perhaps maybe you need the account number to set up direct deposit for your paycheck at work. Knowing where to find your bank account number on your checks can come in handy. The fact that the account number appears on each of your checks in an easy-to-find location is a good reason to keep your checkbook safe and secure.

How to Find Your Routing Number on a Check

Until you’re asked to supply it, you may not know what routing numbers are or how many digits are in a routing number. A routing number is usually specific to the state where you opened your bank account. Some banks have different routing numbers for different kinds of transactions. For example, the routing number for your bank in your state might be different depending on whether it’s for electronic payments, wire transfers or ordering checks.

What does a routing number mean? Think of it as an identifier for your bank. ABA routing numbers, routing numbers assigned to banks by the American Bankers Association, have nine digits.

If you log on to your bank’s website, you should be able to find your bank’s routing number in no time. It’s a common question. Bank routing numbers are important for sending money back and forth between banks. And if you want to close a bank account and transfer funds from your old bank to a new bank, you’ll need that routing number.

When You Need Routing and Account Numbers

You need your routing and account numbers any time you set up a direct deposit, such as receiving a paycheck, tax refund, or government benefit. These numbers are also required when authorizing automatic bill payments, linking external bank accounts, or setting up transfers between banks. They help identify your financial institution (routing number) and your specific account (account number), ensuring that funds are deposited or withdrawn correctly.

You may also need these numbers when setting up payments through a payment app, sending money through an online banking service, or providing information for loan applications or account verification. In some cases, paper checks will include both numbers at the bottom, making it easy to find them. It’s important to keep this information secure, as it can be used to access your account if misused.

Other Ways to Find Routing and Account Numbers

You can find your routing and account numbers in several places besides paper checks. One of the easiest ways is through your online banking or mobile app. Most banks list these numbers under account details or settings. Some apps even have a section labeled “account info” or “routing and account numbers” where you can copy the numbers directly for transfers or deposits.

Another option is to contact your bank directly. You can call customer service, visit a local branch, or use your bank’s secure messaging system to ask for the information. Your monthly bank statements—paper or electronic—may also include these numbers. If you have a checkbook, the routing number is usually the first nine-digit number at the bottom, followed by your account number.

Bottom Line

Now that you know how to find your account and routing numbers on a check, you’ll be ready when you need them for a payment or transfer. If you’re unsure which routing number to use, you can always call your bank to confirm. The check number is usually in the top right corner or at the far right of the numbers along the bottom.

Tips for Managing Your Finances

- Savings and investments can be a lot to figure it out. To ensure your financial plan is in good shape, it might be worth speaking to a financial advisor to help you sort it out and to answer your questions. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Savings account interest rates are a constantly changing environment. So try to keep tabs on where the market is if you want to maximize your savings potential. To help you get started, check out SmartAsset’s list of the best savings accounts on the market.

Photo credit: ©iStock.com/Oddphoto, ©iStock.com/Oddphoto