The clock is ticking on one of the most sweeping tax overhauls in recent history. Now that 2025 has ended, many of the individual tax provisions created by the Tax Cuts and Jobs Act are set to expire, potentially reshaping how much Americans pay in taxes starting in 2026. For households, investors and business owners alike, understanding these looming changes now could make the difference between an unwelcome tax surprise and a well-prepared financial plan.

Curious what you should do for your own taxes? Consider talking to a financial advisor.

What to Know About Potential Tax Complications

In 2017, the Trump Administration passed one of the largest tax cuts in U.S. history. While this was a complicated law with many moving pieces, it focused broadly on three main areas: reducing corporate taxes, reducing high-income individual taxes, and doubling the standard deduction for individuals. Beyond that, the Tax Cuts and Jobs Act (TCJA), rearranged a large number of deductions and tax breaks.

As is relatively common practice, Congress wrote many of the TCJA’s provisions to expire within a set number of years. This is known as a “sunset provision.” In theory, legislators use this when they want a law to address a temporary condition, or when they want to test a law’s impact before making it permanent. In practice, it may be implemented as a budgeting tactic to make laws seem less expensive at the time of passage.

While most, if not all, of the corporate tax cuts in the TCJA were written to be permanent, many of the law’s changes to the individual tax code are scheduled to sunset in 2025. This means that those provisions will apply for tax year 2025, but will not apply to tax year 2026.

This has created significant uncertainty around the tax situation going forward. That said, the incoming Trump Administration, along with Republican leadership in both the House and Senate, have said they intend to make these tax cuts permanent. That does not mean there will be no changes, but with Republican majorities in Congress and a Republican White House, it is likely that many, if not most, of the TCJA provisions will be extended.

Here are the most important parts of the tax law that are set to expire unless they are extended. You can also connect with a financial advisor who can help you navigate and prepare for changes to the tax code.

1. The Standard Deduction and Personal Exemptions

The TCJA eliminated what were called “personal exemptions.” These were dollar amount deductions that you could claim for yourself and your dependents, effectively allowing larger families to claim larger deductions.

The law also roughly doubled the size of the standard deduction. This is a dollar amount reduction to your income that all taxpayers can claim as an alternative to itemizing their taxes. Since most households use the standard deduction, in practice this gave a tax break to most individuals. This tax break somewhat offset the elimination of personal exemptions.

If the TCJA expires, in tax year 2026 an individual will receive a personal exemption of around $5,300 and a standard deduction of around $8,350 ($13,650 total). If the TCJA is extended or made permanent, in tax year 2026 an individual will receive a standard deduction of $15,450 and no personal exemption. If the law expires, a married couple will receive a personal exemption of $10,600 ($5,300 per person) and a standard deduction of around $16,535 ($27,135 total). If the law remains in place, a married couple will receive a standard deduction of $30,725 and no personal exemptions.

This change would be most significant for families, as this element of the TCJA effectively raised taxes for people with dependents. For example, if the TCJA expires a married couple with two children will be able to reduce their taxable income by $37,735 ($5,300 personal exemption * 4 + $16,535 standard deduction). If the TCJA is extended, that same family will be able to reduce their taxable income by $30,725 ($0 personal exemptions + $30,725 standard deduction).

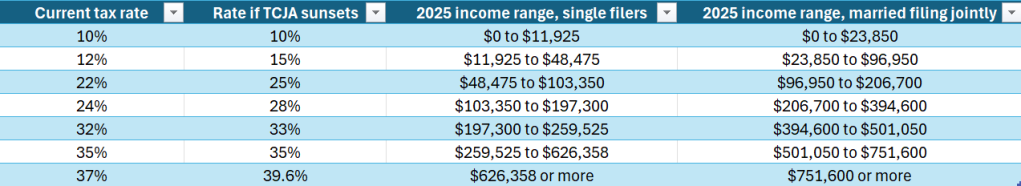

2. Tax Brackets

The Tax Cuts and Jobs Act also lowered some of the tax brackets. If the law expires, those brackets will reset to their levels in 2017. Here is how the current rates compare with the potential changes based on the 2025 income thresholds.

3. Line-Item Deductions

Many itemized deductions were restructured or eliminated by the TCJA. This was, in large part, due to the increased size of the standard deduction. Some of the most significant line-item deductions that will change if the TCJA expires include:

- Miscellaneous deductions, including tax preparation and financial services, will return

- State and local tax deductions above $10,000 will return

- Mortgage interest will be deductible for larger mortgages

- Charitable contributions will be deductible up to 50% of income rather than up to 60%

- Unreimbursed medical expenses will be deductible up to 10% of income rather than 7.5%

The combined effect of the TCJA was to significantly reduce the number of taxpayers who take itemized deductions in favor of the standard deduction, and to reduce the savings for people who do line-item their taxes.

Consider speaking with a financial advisor if you’re interested in building a tax-efficient strategy to manage your wealth amid legislative changes.

4. Child Tax Credits

The TCJA doubled the child tax credit available to households, from $1,000 per-child to $2,000 per-child. This was designed, in part, to offset the impact of eliminating personal exemptions. (While significantly smaller than personal exemptions, the child tax credit directly reduces a family’s taxes rather than just reducing their taxable income.) The TCJA makes this tax credit refundable up to $1,700 per-child.

If the law expires, the child tax credit would revert to its previous incarnation. As currently written, it would be a fully refundable credit worth $1,000 per-child. It is unclear whether this would be adjusted for inflation, but the law is not currently written to automatically do so.

5. Gift and Estate Taxes

The TCJA doubled the lifetime exemption for gifts and estates. As currently written, an individual can give away up to $13.99 million in their lifetime untaxed, beyond the annual exclusions, whether through gifts or your estate. Married couples can give away $27.98 million.

If the TCJA expires, this will revert to its inflation-adjusted rates of half that value. Individuals will be able to pass up to $6.99 million untaxed, and married couples will be able to give away up to $13.99 million above their annual exclusions.

Consider speaking with a financial advisor for help with your estate plan, gifting and more.

6. Self-Employed and Small Business Taxes

One of the biggest potential changes is the expiration of the 20% qualified business income (QBI) deduction. This deduction has allowed eligible pass-through businesses to exclude a portion of their income from federal taxes, lowering effective tax rates for millions of owners. If it disappears in 2026, many small business owners may see their taxable income jump overnight, even if their actual earnings don’t change.

The TCJA simplified some aspects of the individual tax code, but its sunset could bring back provisions that complicate planning for business owners. For example, alternative minimum tax (AMT) exposure could increase for higher earners, especially those with fluctuating income. More complexity often means more time spent on compliance and a higher risk of unpleasant surprises at tax time.

Uncertainty around future tax rules can make long-term planning harder for entrepreneurs. Decisions about hiring, expanding or reinvesting profits may look different if tax rates and deductions shift in 2026. This is an area where working with a financial advisor or tax professional can be especially valuable, helping business owners model different scenarios and adapt their strategies before the changes take effect.

Bottom Line

The scheduled sunset of the Tax Cuts and Jobs Act in 2026 could reshape the tax landscape for millions of Americans, from higher-income households and families to investors and small business owners. With the potential return of higher tax rates, reduced deductions and more complex rules, proactive planning may be critical to managing future tax bills.

Tips On Managing Your Tax Plans

- Don’t let tax season catch you by surprise. Start planning how you will manage your taxes and file them early, and avoid the April 14 scramble.

- A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

- Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/erhui1979