When Robert Tutela seeks out new clients, he doesn’t solely focus on wealthy prospects with seven figures to invest. Landing million-dollar-accounts is great, but it’s not the only path to success as a financial advisor, says Tutela, an advisor and portfolio manager at Essex, LLC in Illinois.

“I’ve always been of the mindset, if you’re willing to commit to the plan that we put together for you, and maybe you fall short of conventional minimums, I’m always willing to work with you,” Tutela said.

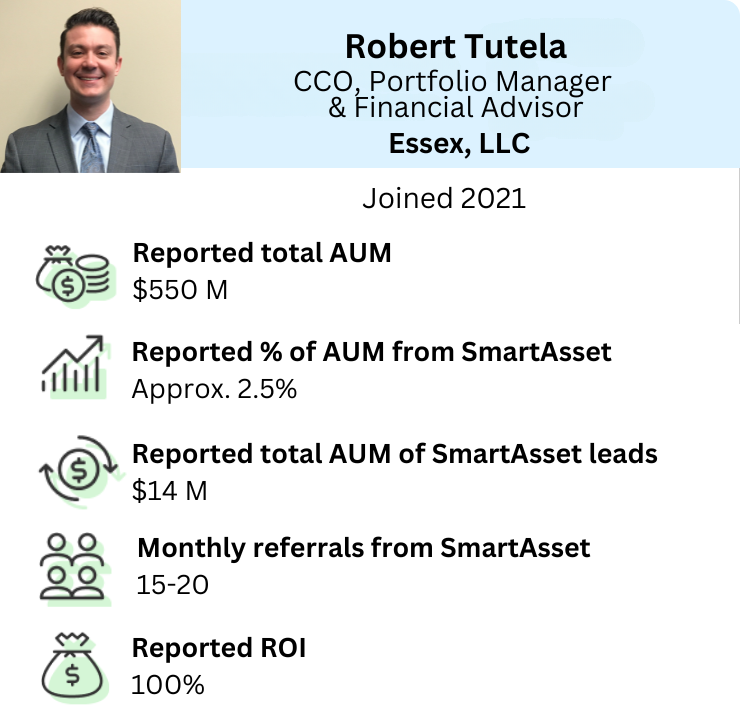

Tutela also credits SmartAsset with helping drive Essex’s recent success. In a conversation with SmartAsset CEO and founder Michael Carvin, he said the firm has added about $14 million in reported assets under management (AUM) since joining the platform.

Tutela attributes that success to a consistent, persistent approach when working with SmartAsset referrals. His firm makes a point to follow up with leads even after long periods of inactivity, sometimes reaching out a year or more after the initial contact.

“And it wasn’t just luck. It was because we kept doing what we were doing. We didn’t let anything discourage us.”

Looking to grow your business? Learn more about how SmartAsset AMP helps advisors connect and communicate with leads.

Interview Transcript

Michael Carvin: Hi everyone. I am Michael Carvin. I’m the CEO and founder of SmartAsset. I’m joined today by Rob Tutela, one of our financial advisors. So welcome to our Success Series, Rob. Welcome to the program here.

Robert Tutela: Thank you, Michael. I appreciate it.

Michael Carvin: I’d love to start by just hearing a little bit about yourself and how you got into wealth management.

Robert Tutela: Sure. Shortly after graduating college, I made my way into the world of finance. I was living in New York, so the obvious low-hanging fruit was throwing in job applications at a variety of big banks in New York City. I was lucky enough to be picked up by J.P. Morgan. I spent the early stages of my career working with them under their asset management division, learning more about portfolio management and service along with some trading. That paved the way for me to then leap into the RIA world with Essex about eight, nine years later.

Since making that move, I’ve found that working on this side of the desk can be a lot more rewarding if you’re doing the right things and servicing your clients in the right way. You actually feel like you’re helping people, as opposed to just working for a big organization and meeting the needs of their agenda. So it’s a pleasant change.

Michael Carvin: I know you’ve been a partner of SmartAsset for a number of years now. How did you approach organic growth before working with SmartAsset? And what is your approach to organic growth today?

Robert Tutela: Yeah, so rewind back to 2019-2020—COVID, right? Everything shut down. It was really hard to access prospects by way of conventional—in those days—prospecting means: going out to get-togethers, networking lunches, just being social with people, right? It didn’t exist with a snap of a finger. Everybody was stuck inside their house.

The CEO of Essex and I sat down, and we started looking at other options for prospecting tools. We kept hearing about online lead generation—just the next wave of what’s going to take the RIA industry by storm in terms of AUM growth. So we started poking around and looking at different options, and SmartAsset stuck out to us as kind of the market leader.

And [it was] a good way to kind of dip our toe in the water so to speak. It wasn’t really difficult to onboard and take a bite-sized piece of what we felt was a reasonable budget just to experiment with things. The initial experience was challenging, but seemed promising, right?

So it’s all about how you work the leads, consistency, delivering a good product and not letting the failures hold you back. I find that if you’re going to do this kind of outreach, where it’s not a formal introduction from somebody that you’re already working with—or a referral, word of mouth—you’re already fighting an uphill battle.

So you’re going to get hung up on, you’re going to be told no, right? And if you are willing to take no for an answer, then everybody knows what happens. But if you’re not, and you want to be persistent and try and prove to somebody that the opportunity is worth something, then you’re going to have success, right? It’s just a matter of time.

Michael Carvin: And was that the nature of the challenge in the early days? Was it getting people on the phone in the first place, or was it when you got them on the phone, it was hard to have a good dialog with them?

Robert Tutela: I would say 50/50, right? Back when the platform first started, before there was integration with DeftSales, it was a very manual process. Aside from the regulatory piece, where you had to kind of keep track of your own correspondence—exactly when, what, who, all the pertinent details—the challenge was just getting somebody to engage with you, right? And I feel like a lot has changed in the last four or five years too, with the receptiveness with regard to the prospects that fill out the surveys. Again, back in 2020, everybody was on the computer. It was e-commerce. It was everybody’s on social media to stay connected. Everybody’s searching online for things just to kind of keep engaged. And maybe they filled the survey out just because they were bored. So the validity of the submission may not have been as strong.

But now with more of a public presence, not just from SmartAsset, but just in general from online lead gen. In order to search for an advisor or search for anything, really—whether it’s somebody coming to do a home renovation, a plumber, an electrician—these are more reputable sources now just by way of the evolution of the way we live.

It’s one thing to say, “Hey, I manage a portfolio for you.” That’s great, right? But it’s another thing to say, “Well, I can do that and all of this, and so much more.” You can really make a difference in somebody’s life. You can open their eyes and they stop and say, “Wow, I never really thought of working with a financial advisor as having that kind of impact beyond just my portfolio.”

Michael Carvin: Yeah. And so what were some of the insights that changed your experience from being a challenging one to driving success?

Robert Tutela: We had always gone into this thing knowing that it was a numbers game—statistical probability, right? I mean, you go back to the old days where people were buying books of names and just cold calling and getting hung up on 99% of the time. We always knew it was going to be like that.

But when it changed was probably, I’d say nine months in, maybe a full year in. We started really seeing engagement across the board—whether it be by way of email, by way of phone or a combination of the two. Live leads were something that was kind of unique that really sparked our interest as well. We were getting calls on live leads more frequently, so it was almost like sentiment just changed in terms of the consumer base using SmartAsset to find the advisor.

So the fact that we didn’t let up off the gas pedal through all that really created a hockey stick in terms of the return on investment for us in terms of our time and our energy—never mind the dollars we were pumping into the platform. But once we were able to engage with people—I feel like that’s the uphill struggle, right? Getting somebody to stop, give you 15 minutes to listen and really show that person how you can help them. After that, it’s downhill.

Michael Carvin: And you’re talking of metrics. Can you share some?

Robert Tutela: Last year alone, we did about $10 million—close to $10 million—on the platform. Obviously assets come in, assets go out, so we’re working on a net number. Last year was a great year.

I’ve found that when the market is like it is now—very choppy, very volatile, there’s a lot going on geopolitically, economically, market trends, we’ve got shake-ups in the White House, change, uncertainty—everybody seems to pause. It’s the “deer in headlights” effect, is what I like to reference it as. And everybody’s guilty of it; some are more galvanized than others, and those that are not galvanized tend to have a more emotional reaction. But that’s even more of a reason to work with an advisor to help temper that emotional reaction, because that’s the one thing you don’t want to do is invest with emotion. You need to invest with a calculated approach and learn to stay the course when you’ve decided on one. We are our own worst enemy.

So just being able to experience both the up markets and the down markets—’22 is another case where we found it really hard just to generate engagement. But then you move on to 2023 and everybody was ready to go, right? Once the Fed came in and started cutting rates, markets started to take off again. Everyone was willing to change.

Again, if your value proposition is one that kind of embodies the true sense of [being] a fiduciary and the true sense of a comprehensive registered investment advisor—comprehensive planning, asset management, everything that affects your wallet or pocketbook, good or bad—and you can show them that, it’s really not all that difficult to secure a prospect and get a meeting. Once you’ve got the meeting, you’re 80% of the way there.

Michael Carvin: And how do you think about the return on your investment? It sounds like you generated $10 million in new assets last year. You know what you spent to do that? How do you think about your ROI?

Robert Tutela: Our budget to date was about $6,000 a month, or is about $6,000 a month. So obviously, generating that kind of a number, we’re looking at in aggregate the entire span of our investment with SmartAsset relative to the total AUM on the platform, plus those incoming flows for last year, we’re at about a break-even point.

So when we see something like that—I mean, the whole reason we went into this was to create a proof statement. Our goal in doing all this is to prove out that this platform works, and the more you throw at it, the more rewarding it becomes.

Ultimately, if we were to develop a team of salespeople—juniors and seniors—we could create a hierarchy of people that call and focus on outreach to then funnel into senior advisors that would come in and close, as well as work with those newfound. And to do it in a way—not at $6,000 a month—but eventually maybe it’s $60,000 a month, right? I mean, as big as the number can get, sustainably, is what we’re willing to do if we can prove that it works, right? I’ll rent more space, I’ll hire more people. That’s not the problem. I need to make sure the return on investment is there and the formula works.

Michael Carvin: For 2024, you were spending about $6,000 per month—say about $70,000 for the year—and generating $10 million in new assets. I’m going to guess, rough numbers, you’re charging about a percent?

Robert Tutela: We’re a flat 1%. And then you have to look at when those assets came in. So if 70% of those assets didn’t come in until halfway through the year, it’s only 50% attribution relative to the AUM on a 25 basis point per quarter calculation. But the pickup is never going to be in year one, right? You’re always looking at year one as a sunken cost, and you’re picking these clients up to then cover the cost for the subsequent year. So, you know, as long as you can keep that train rolling, it should in turn pick up more and more and more speed as you go. You can’t let off the gas pedal. You can’t get discouraged.

Even when markets are like this, and it’s really easy to feel uneasy or unwilling when you don’t have that receptiveness coming from the leads that you’re purchasing, but it’ll be there. I’ve had experiences with clients that I’ve never talked to, by way of DeftSales just kind of emailing outreach, campaign outreach. I had one at the end of last week. It was the last email in a set of 45 steps. She came in for a meeting on Thursday, a day after that last email went out. She’s like, “I’m so glad you emailed me. The reminder just kind of fell in my lap, and I’ve been looking for somebody. Everybody I’ve been meeting with wasn’t really the right fit.” I feel strongly—probably about a 9 ½ out of 10 in terms of gauge—that she’s going to come on [as a client] in the next few weeks. So even the ones that you think have gotten away aren’t necessarily gone, out of the picture.

We do make a practice of circling back. Even though you’ve sent this lead a dozen emails and you’ve called them a dozen times, and it’s been a year since they came through the interface, doesn’t mean that person hasn’t found an advisor. Life gets in the way. Things happen. People are indecisive, they don’t know what to do. So being persistent and being thorough, even on the old stuff that’s lying dormant, can prove to be profitable.

Michael Carvin: Tell us about the kind of consumer that you’re turning into clients. Are they people with $100,000 of investable assets? A million? Are they looking for financial planning? Estate planning? How do you think about that?

Robert Tutela: We’re a bit unique in that regard. I mean, obviously everybody likes a million-dollar client.

I’ve always been of the mindset that follows a more moral and ethical path. Especially if they’re younger, not a lot of people have a million, even half a million, but they want to do the right things. They want to save. They want to be investing in the right places, diversifying their portfolio appropriately, refining protections in their life. Maybe they’re looking to buy a house, they’re looking to weigh the cost/benefit of renting against owning. Working with somebody who can help you run all those calculations and forecasts, put together a plan for you and help guide you through decision making.

Just because you don’t have half a million dollars, or a quarter of a million dollars or whatever the minimum is, shouldn’t act as a deterrent for that person getting that help. So I’ve always been of the mindset, if you’re willing to commit to the plan that we put together for you, and maybe you fall short of conventional minimums, I’m always willing to work with you. It’s more about the effort with which you show and/or put into working the steps of said plan, versus the assets you bring to the table on day one.

A lot of the earliest clients of Essex—and we’re going back over 20 years—started by depositing just $100 a week from their paycheck. And now they’re sitting on eight-, nine-, 10-, $12-million-households because they made the right choices. They tightened their belt when it came to a budget and spending. Where you save, how you save. If you run a business, you’re a business owner, right? The solutions that we can put in front of you to save on taxes but keep money in your pocket and maneuver from year to year will make a big difference when you look at it from a zoomed-out perspective. Take a step back and just really look at the growth over time. It makes a big difference.

Michael Carvin: That does make a big difference. And so what tips would you have for an advisor that—maybe like you guys when you first got started—was having some challenges? What tips would you have, either in how to do the outreach, or how to close more business?

Robert Tutela: For starters, I think you’ve got to learn to fail, right? Some people have that natural, God-given sales mentality, where you can get hung up on 100 times and you still make that 101st phone call with the same tenacity and enthusiasm as you did the first. If that’s your hurdle coming into this, learn to fail. Nothing ever came to anybody without failure being the first step—it breeds success.

The second is, learn to develop your value proposition. If you don’t have a good value proposition, I would encourage you to refine your process so that you’re doing something that sets yourself apart from your competitors, or at least does justice in the eyes of the prospect you’re talking to. “Why is my time as a prospect worth sitting here talking to you? What are you going to do for me that I can’t do myself, or that my existing advisor can’t do for me?” I see that a lot on the surveys—“I’d like another advisor’s perspective” or “I’d like a second opinion.” And it’s not necessarily about that second opinion. Sometimes it’s just learning to be likable.

If you have a good attitude, a good head on your shoulders and a sound plan for that person and their short- and long-term goals, that’s all you need. Versus the advisor that’s more like dry white toast, that doesn’t have the personality, doesn’t have the likability. Not that they’re not a good person or can’t socialize, but it’s a working relationship. I mean, these people are hiring you to do a job, but at the end of the day, they’re trusting you with everything they have.

So if you can take that relationship and one-up it to a real relationship where you become friendly with them as well as professional with them, the connections that you make in doing so really do justice for the business.

I’d say 99% of the clients we have here at Essex are “sticky,” right? Very low turnover. And it’s because of those relationships that we form with our client base, beyond just, “Hey, I’m the guy that manages your portfolio.” Pick up the phone and they’re talking to me about their kid’s baseball game, or their daughter’s dance recital or the vacation they just went on. It’s becoming more of a piece of their life, from year to year, from stage to stage. They really want to and like working with you. So, I feel like that does help a great deal as well.

Michael Carvin: That’s great advice. It really is a relationship-driven business. I’m curious, are there KPIs that you pay close attention to to make sure you’re on track? What do you look at and what can you share there?

Robert Tutela: What I like to see at the very least is that—I’m engaging with or when the leads come through—I’ve got at least one lead from each month’s worth of lead sources that I’ve had the opportunity to sit with, whether it be on Zoom, whether it be on a phone call, in the office. I find that when you can get that initial meeting in whatever format best fits the prospect, the chances of your close rate jump by more than 50%.

Assuming you can deliver that value proposition and connect with that person on a level that supersedes what their expectations are or what their existing relationship kind of embodies. Once that happens, it’s pretty easy to close.

Again, I find it does depend on some other peripheral factors, like what’s going on in the world around us market-wise, economic-wise, geopolitically. But all that being said, even just having that conversation and getting on somebody’s radar doesn’t necessarily mean you’re down for the count if they say, “You know what, some things have changed. I really like you. I enjoyed our conversation. You opened my eyes to a few things. I’m just not ready to make that move.” Six months later, they might be knocking on your door again. So I find that if I can get at least one to two meetings—or engagements, let’s call them—from each month’s worth of leads, there’s a good chance that everything else kind of follows suit, rolls in on the back end as it should.

Michael Carvin: And can you share how much AUM you’ve raised through SmartAsset? Do you have that?

Robert Tutela: We had about $14 million that came by way of SmartAsset over the life of the account. I’ll say the first couple years were a little choppy, and then in ‘22 things kind of slid off, but between ‘23 and ‘24 things really picked up.

And it wasn’t just luck. It was because we kept doing what we were doing. We didn’t let anything discourage us. And you know, the “hockey stick effect” was very real. And assuming the markets cooperate a little bit this year, I think we’ll have another really good year. There’s a ton in the pipeline still. I’ve got about another $14 million in the pipeline from either last year or the current year. If I were to scrape ‘23 and ‘22, I could probably come up with another five to 10 million that is still a viable source of—let’s call it—prospecting material and we will definitely do that. But it’s looking good. We’re feeling good. And we’re very, very excited to be a part of the platform, and just proving out that this does work if you work it.

Michael Carvin: Robert, thanks for sticking with it, and thanks for your time today. This has been great.

Robert Tutela: Thank you. I appreciate the opportunity. It was a pleasure to chat, and you have a great day.

Testimonials appearing on this site are actually received via text, audio, or video submission. The testimonials are provided by financial advisors that have ongoing business relationships with SmartAsset. They are individual experiences, reflecting the real-life experiences of those who have used our products and/or services.

The testimonials are not 100% representative of all of those who will use our products and/or services, and we make no admissions of such.

The testimonials displayed (text, audio, and/or video) are given verbatim except for correction of grammatical or typing errors. In some cases, the testimonial has been shortened in length where it has not been possible to display the whole testimonial, and where we considered, acting reasonably, that some parts of the testimonial were not relevant to our site, products, or services.

SmartAsset may extend free products, discounts, promotional support, or other indirect or direct financial incentives to these sources. These incentives may or may not influence the nature of the testimonial. In this case, compensation was provided.