If you spot a Tesla on the road, you may be impressed by the sleek style of the car, but you may also find yourself wondering: How do you take an electric car like that on a road trip? How do you refuel conveniently? The answer is EV charging stations. As electric vehicles grow in popularity, so does the demand for these stations, making the sector an especially hot one for investors.

If you want expert advice on building an investment portfolio that serves your current and future needs, consider working with a financial advisor.

What Is an EV Charging Station?

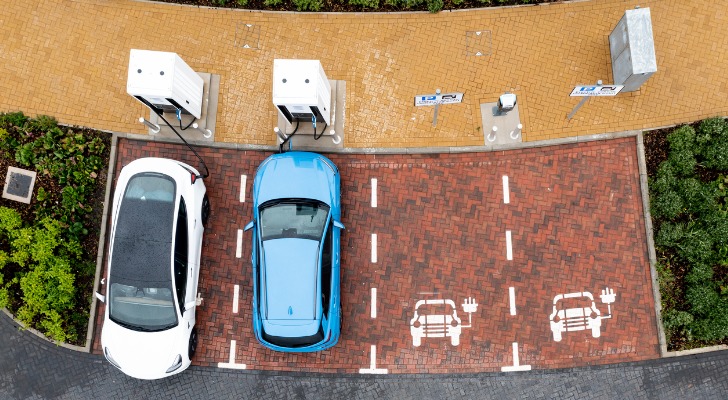

An EV charging station is essentially a gas station for electric vehicles (EVs). According to the U.S. Department of Energy, while most EV owners have charging stations at their homes, there are tens of thousands of EV charging stations across the country. Whether these are public charging stations or workplace charging stations, they serve the same purpose of recharging the batteries of electric cars.

While the purpose of an EV charging station most resembles a gas station, the actual process is more like recharging your phone. As you might have a phone charger at home but also carry one with you to the office, if you have an EV, you might be best served by having a residential EV charger while still having access to public EV charging stations or an EV charging station at your work.

Are EV Charging Stations Good Investments?

EV charging stations can be good investments as the market for EVs and the accompanying infrastructure to power them grows. According to the U.S. Bureau of Labor Statistics, there is increased consumer demand for EVs and many reasons to believe that that interest will continue to grow.

In 2011, electric cars made up 0.2% of all car sales in the United States. By 2021, that number had swelled to 4.6%. EV sales then made up 18% of all car sales in 2023, up from 14% the year before. While this shows great growth in the U.S., it pales in comparison to the country with the largest market share, Norway, which sits at about 90%. Some EV car sales have also started to decline in 2025, so there is a lot to invest in before deciding if it’s the right investment.

While environmental concerns have been a major concern for EV drivers historically, cost savings also figure prominently in the move to EVs. Studies find that EVs can save their drivers as much as $12,000 over the life of the vehicle, and that fuel savings alone can be $4,700 or more in the first seven years of owning the vehicle.

Further savings are available for EV buyers thanks to government policies. The Infrastructure Investment and Jobs Act allotted a tax credit worth up to $7,500 for EV buyers until 2032. That same bill committed $7.5 billion to build out national EV charging infrastructure.

Between personal reasons, cost savings and ongoing improvements to the affordability and battery life of EVs, it’s clear why investors would consider EV charging stations a wise investment.

How to Invest in EV Charging Stations

EV charging stations can be a wise investment for business owners. EV charging stations can be expensive to install, but the Infrastructure Investment and Jobs Act has set aside $1.5 billion to help states build and expand their EV charging networks. Look into your state’s EV charging station plan to see what assistance is available to you, for instance, in Illinois, the Illinois Environmental Protection Agency will offer a rebate of up to 80% of eligible project costs.

Once you’ve set up your charging station, you can charge drivers for the electricity they use to recharge their cars, using a business model similar to a gas station. But EV charging can also generate income for your business in less straightforward ways.

Say you own a restaurant and decide to install a charging station. A driver on a road trip looking for a charging station sees your restaurant nearby and decides to pull in and charge their car. Charging can take between 20 and 55 minutes, the perfect amount of time for that driver to grab a bite to eat as well. This strategy can apply to a variety of retail establishments, including shops, bars, convenience stores and more.

If you’re not a business owner or don’t want to create and maintain your own EV charging station, there are other ways to invest. You can invest in the companies that are creating and selling charging equipment and technology, such as Tesla, Chargepoint or Tritium, by purchasing stock. You can also invest in EV-related mutual funds or exchange-traded fund (ETFs).

Alternatives to Investing in EV Charging Stations

Investing directly in electric vehicle (EV) charging stations can be capital-intensive and complex, but there are several other ways to tap into the growth of the EV industry without owning or operating charging infrastructure yourself. As demand for electric vehicles accelerates, opportunities exist across the entire ecosystem, from battery production to clean energy and technology partnerships. Here are some alternative ways to invest in the EV charging space while diversifying your portfolio.

- Invest in publicly traded EV charging companies: If you want exposure without the operational headaches, consider buying stock in established EV charging companies. Firms like ChargePoint, Blink Charging and EVgo are traded on major exchanges and provide direct participation in the sector’s growth. However, since these stocks can be volatile, it’s wise to research each company’s business model, partnerships and market share before investing.

- Explore EV and clean energy ETFs: Exchange-traded funds (ETFs) that focus on electric vehicles or renewable energy offer broad exposure to the EV ecosystem. These funds often include a mix of automakers, battery manufacturers, and charging infrastructure companies, providing instant diversification. They’re a convenient choice for investors who want to benefit from the sector’s long-term momentum without betting on a single company.

- Invest in utilities and renewable energy providers: As EV adoption rises, the demand for electricity will grow too, making utility and renewable energy companies potential winners. Many power providers are expanding into EV infrastructure and green energy initiatives, offering steady returns through dividends and growth tied to increased charging demand.

- Consider real estate partnerships: Some investors participate in the EV boom by leasing commercial property to charging companies or installing stations at existing locations. Partnering with businesses that need on-site charging, such as hotels, retail centers or multifamily housing, can provide a new income stream without having to manage the technology directly.

- Look at battery and semiconductor companies: Charging stations rely on advanced batteries, power management systems and semiconductor components. Investing in the companies that produce these materials and technologies can give you indirect exposure to EV charging growth while benefiting from broader trends in clean tech and automation.

You don’t have to own or operate charging stations to benefit from the electric vehicle revolution. By investing in related industries, such as EV manufacturers, clean energy or component suppliers, you can participate in the sector’s expansion while managing your risk more effectively.

Bottom Line

As EVs become more popular, the demand for charging stations will continue to rise. Business owners who invest in EV charging stations can enjoy an additional revenue stream as well as the potential for increased foot traffic and a new customer base. Individual investors who see the promise of the sector can buy in via stocks or ETFs.

Tips for Green Investing

- Consider talking to a financial advisor about the pros and cons of green investment strategies and how you might implement them in your portfolio. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Want to take a look at what your portfolio will look like in a decade? SmartAsset’s investment calculator can help you do just that. Enter how much you have invested, how much you’re contributing and what rate of return you expect. We’ll then show you your investment growth five, 10 or even 30 years into the future.

Photo credit: ©iStock.com/Marcus Lindstrom, ©iStock.com/Brothers91, ©iStock.com/Teamjackson