| You currently are covering only final expenses and legal fees, update your information on the left by adding a spouse or dependents if you would like to leave additional money behind for your family. | How much money do you want your family to receive annually? % of income Dismiss | How many years of income will your family need? Dismiss | Your Insurance Need: |

| Your Insurance Need: | |||

- About This Answer

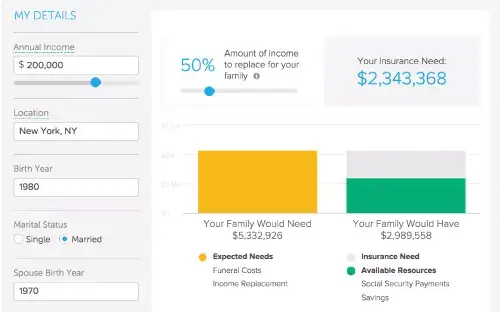

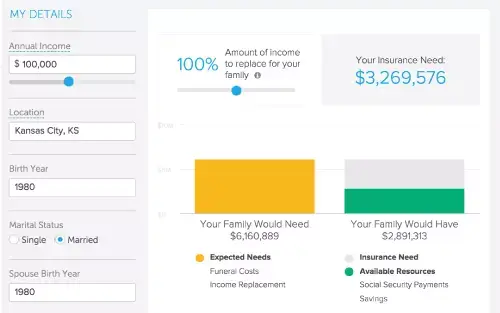

Understanding the correct amount of life insurance to get is an exercise in forecasting your beneficiary's future financial needs, assuming (unfortunately), that you were to pass away today. Formally this process is called a "Needs Assessment Analysis.” To calculate your beneficiary's future financial needs we determine the amount of income that would need to be replaced, and the impact of one-time expenses like the settlement of a mortgage or paying for college education. In this calculation we consider taxes and interest income from savings. We then do a calculation that tells us the correct lump sum to pay your beneficiary upon your death (such that the needs of your beneficiaries would be covered in the future). At the same time we are calculating the value of all of your income sources, including any death benefits, Social Security income, savings and interest income. The difference between your beneficiary's total needs and your total resources is the amount we recommend you purchase in life insurance.

- Our Assumptions

Income replacement: We assume that your dependents would like to replace some percentage of your income once you pass away.

Life expectancy: We assume your spouse lives to be 95.

Social Security: We estimate survivor benefits based on your Social Security income, using your stated annual income and assuming you have worked and paid Social Security taxes for 35 years. Additionally, we calculate your spouse’s potential Social Security benefit if they work and take the higher of that or the survivor benefit.

Return on savings: We use a default assumption of 4%. This number is important in our calculation of "opportunity cost.” You can edit this input on the left side of the page.

Mortgage settlement: We assume that the mortgage balance of your home is paid off immediately with the life insurance payout.

Debt settlement: We assume that any debt balances you have are paid off immediately with the life insurance payout.

College education expenses: If you elect to cover your children for college, we assume you pay for a 4-year college program.

Inflation: We use a default assumption of 2%. You can edit this in our "Advanced" input section.

How Much Life Insurance Do I Need?

Want to protect your dependents in case something happens to you? We thought so. While buying life insurance may not be the world’s most exciting way to spend money, it’s one of the smartest financial moves you can make. The tricky part is figuring out the answer to the question, How much life insurance do I need to buy to ensure that my family is comfortable and worry-free?

Here’s our no-excuses primer on life insurance:

Yes, this life insurance calculator is for you

But I have life insurance through work…

Nice one! But you still need coverage that will follow you wherever you work. When you leave your current job, you won’t be insured and your family won’t be protected. If you wait until you leave your job to search for life insurance coverage, you’ll probably end up paying more because you’ll be older. Plus, employer-paid policies usually don’t replace as much lost income as people really need.

But I’m a stay-at-home parent…

Just because you’re not generating income doesn’t mean you’re not generating value for the family—value that would have to be replaced if you weren’t around. If something happened to you, imagine the cost of hiring caregivers to attend to the needs of your children. Your partner would have to hire someone to do everything you do now, from childcare to cooking and shopping. That doesn’t come cheap, so make sure you don’t undervalue your contribution to the family by skipping life insurance.

But I work out and eat lots of kale…

Awesome—you’re immortal! Oh wait, you’re not. Death comes to all of us, even to the svelte and vegan. We’re not saying you should stop taking care of yourself, just that you should think of having life insurance as one of the ways you take care of yourself. It’s often the most health-conscious people who are the most reluctant to shop for life insurance, even though they may be eligible for reduced premiums as a reward for their healthy lifestyle. Take advantage of the lower life insurance cost available to you by virtue of your exemplary diet and exercise habits.

We still mean you

If something happened to you, your loved ones wouldn’t just lose your future earnings. They would also be on the hook for some of the debts (in certain states), medical bills and funeral expenses you left behind. Life insurance is there to cover these costs, but only if you bite the bullet and sign up for a policy.

But I don’t have dependents…

Even if you don’t have dependents who rely on your income, someone would step up to cover the costs of your funeral, right? That person might be a parent or other relative who would fork over the roughly $10,000 for your burial in the event that something happened to you. The average cost of a funeral in America is currently between $7,000 and $10,000 dollars.

What’s called “final expense life insurance” can be a smart way to ensure you’re taking care of your own expenses rather than leaving someone else to settle your final debts. Final expense insurance pays a fixed death benefit directly to your chosen beneficiary. The policy beneficiary can decide whether or not to apply the money to burial expenses, and you can rest easy—no pun intended—knowing you did the responsible thing by making provision for final costs.

And remember, it’s not just children that you want to think about. Perhaps you have parents who you help support or would like to help support (or simply pay back for those troubles during your teenage years!). Other beneficiaries could include siblings, nieces, nephews or friends.

Another option for people who don’t have dependents is to name their favorite charity as the beneficiary of their life insurance policy.

But I can’t afford it…

How much is life insurance, anyway? A good life insurance premium calculator (like our life insurance quotes tool) can help you answer that question. One of the biggest myths associated with life insurance is that it’s expensive. In fact, life insurance premiums can be quite cheap, especially if you lock in rates while you’re young and healthy.

But I have lots of money in assets…

Cool! But are you sure you have enough to offset the loss of your income now and in the future? And are the assets liquid enough that your dependents could use them to cover final expenses? Will those assets be tied up in probate, leaving your dependents to pay funeral costs up front? You get the idea. Even people with a healthy amount saved up can still benefit from life insurance.

And if you’re wealthy enough that your estate will be subject to steep estate taxes, life insurance can be a way to help your heirs offset the income lost to taxes. If your spouse is the beneficiary of your life insurance, the benefits from your policy will generally pass to him or her income tax-free after your death (though estate taxes may apply if the deceased is the owner of the policy). In other words, there can be tax advantages to life insurance.

And here’s how we can help

But shopping for life insurance sounds hard…

You’ve come to the right place. At SmartAsset we make life insurance easy with our interactive tools like this life insurance calculator (see above). Tell us the basics about your age, health, income and dependents and we’ll tell you the answer to that question, How much life insurance do I need? Then, you’ll be able to use our site to learn more about the different kinds of life insurance, compare policies and find out who the most trustworthy insurance providers are. We’ve got you covered.

Now that we’ve addressed the usual reasons people shy away from life insurance, we can talk about how much you need and help you understand the factors that go into our calculations.

How much do you make and what are your assets? The amount of life insurance people buy is usually calculated as a factor of the person’s income. And depending on the other resources your dependents will have after your death, you may not need to pay for a policy that replaces 100% of your lost income.

How old are you? Just starting your career, with 40+ years of income to replace if the worst happened? You’ll need a bigger policy.

Are you old enough that your widow/widower would be able to claim Social Security survivor benefits if you died? You probably don’t need a huge life insurance policy. Just remember that life insurance isn’t only for the young. With life expectancies for today’s young people stretching into the eighties and beyond, everyone needs to be planning for—and saving for—a long retirement.

Does your spouse work? If not, you’ll need a lot more in life insurance. If your spouse is a stay-at-home parent, he or she would need to either live off your life insurance or use the money to pay for childcare and return to work. Either way, make sure you’re covered for enough money to support your family.

How healthy are you? Not to be morbid, but one factor that goes into life insurance calculations is how likely you are to, well, die. If your health is an issue then your dependents are especially vulnerable if you don’t have life insurance. People whose health puts them at higher risk of dying during their working years will need bigger policies, but may also pay higher premiums.

How much do you owe? Life insurance benefits don’t just replace your lost income. They also help your dependents pay off any debts you leave behind. If you and your partner have just taken out a mortgage you’ll need a bigger policy. If a relative or friend co-signed a loan of yours, you’ll need enough money in your life insurance policy to help that person pay off the loan. If there isn’t enough money in your estate to pay off the debt, the lender will go after that nice person who co-signed your loans, and you don’t want that to happen. Alternatively, if you co-signed someone’s private student loans, you’ll need life insurance to help the person whose loan you co-signed avoid a default. That’s because many private lenders demand full repayment if a co-signer dies.

Got all that? Ready to shop for life insurance policies? Use our life insurance calculator to find the personalized and accurate answer for you to that question, How much life insurance do I need? Then click over to compare life insurance quotes to find the right policy for you!

The Most Insured Places in the US

SmartAsset’s interactive map highlights the counties across the U.S.with the highest insurance coverage rates. Using the map, you can look at the most insured counties in the country or in each state. Use the tabs to see the places with the most overall coverage, the most auto coverage, the most health coverage or the most life insurance coverage. Zoom into a state and scroll over a county for more information.

Methodology SmartAsset looked at data on three types of consumer insurance products: auto, health and life to find the most insured places in the U.S. We ranked each county in the study based on the insurance coverage rates relative to the population in these three categories. Areas with higher coverage rates ranked the highest on the index.

To calculate the auto insurance rate, we measured the ratio of uninsured drivers to the total driving age population in each state. Places where uninsured drivers made up the smallest share of the population ranked the highest on the auto insurance coverage index.

To find the places with the highest rates of life insurance coverage, we measured the number of life insurance policies in each state against its population. Counties with the highest ratio of life insurance policies to their population ranked the highest on the life insurance coverage index.

Finally, to find the places with the highest health insurance coverage rates, we measured the number of uninsured people in each county against its population. The counties with the highest coverage rates ranked the highest on the health insurance coverage index.

Giving equal weight to each of the insurance indices, each county was then measured on an overall coverage index, with a top score of 100. Counties scored higher on the index based on their coverage rates across each of the three types of insurance.

Sources: US Census Bureau 2017 American Community Survey, Insurance Information Institute, American Council of Life Insurers 2019 State Fact Sheets