How This Calculator Works

Our investment calculator estimates how your balance could grow over time based on a fixed return. Enter an initial amount, choose a recurring contribution schedule and see how consistent investing influences both your pace of growth and your ending balance. The tool also accounts for compound interest, giving a clear picture of how reinvested earnings help your money build over time.

Investment Growth Over Time

About This Calculator

Our investment calculator estimates how your balance could grow over time based on a fixed return. Enter an initial amount, choose a recurring contribution schedule and see how consistent investing influences both your pace of growth and your ending balance. The tool also accounts for compound interest, giving a clear picture of how reinvested earnings help your money build over time.

Assumptions

Rate of Return: We assume that your rate of return compounds based on the frequency at which you contribute.

Contributions: We assume that the contribution will occur at the end of the selected contribution period.

This hypothetical example is for illustrative purposes only and does not represent an actual client or specific security. Actual results will vary.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). Past performance is not a guarantee of future results. There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

Articles, opinions, and tools are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you consult your accountant, tax, or legal advisor concerning your individual situation.

SmartAsset.com is not intended to provide legal advice, tax advice, accounting advice or financial advice (Other than referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States). Articles, opinions, and tools are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you consult your accountant, tax, or legal advisor concerning your individual situation.

It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Indexes do not pay transaction charges or management fees.

The above summary/prices/quote/statistics have been obtained from sources we believe to be reliable, but we cannot guarantee their accuracy or completeness.

Our Assumptions

Rate of Return: We assume that your rate of return compounds once per year.

Contributions: We assume that the contribution will occur at the end of the selected contribution period.

Investment Calculator

Whether you’re just starting to invest or you’re a seasoned investor, an investment calculator can help you figure out how to meet your goals. It can show you how your initial investment, frequency of contributions and risk tolerance can all affect the way your money grows.

A financial advisor can help you manage your investment portfolio. To find a financial advisor who serves your area, try SmartAsset’s free online matching tool.

How to Use Our Investment Calculator

SmartAsset’s investment calculator is a simple tool for visualizing how your money can grow when you invest it over different lengths of time. To use the calculator, enter a few key details to see how your money could grow.

Starting Amount

Say you have some money you’ve saved, you just got a bonus from work or you received money as a gift or inheritance. That sum could become your investing principal or starting amount. This is your jumping-off point for the purposes of investing. Most brokerage firms that offer mutual funds and index funds require a starting balance of a few hundred dollars to $1,000 or more. You can buy individual equities and bonds with less, though.

Additional Contribution

Will you be making a one-time investment or adding recurring contributions? Adding money regularly can help your investment grow faster. SmartAsset’s calculator allows you to estimate the value of additional investments made on a weekly, bi-weekly, monthly, semi-annual or annual basis.

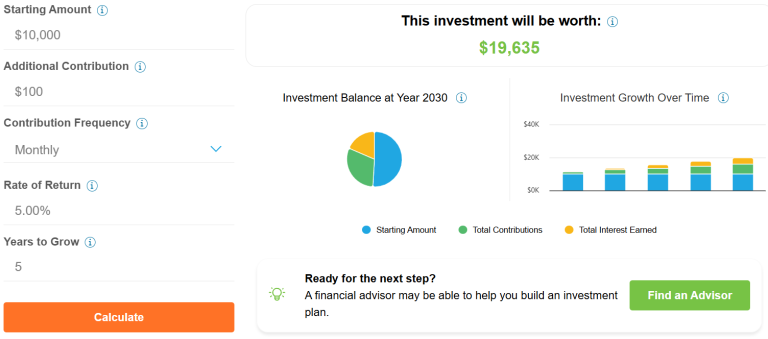

Imagine you have $10,000 in savings that you’d like to invest in the stock market. However, you decide to add $100 to this pot each month. Of course, the higher your additional contributions or more frequently they’re made, the more your initial investment will grow over time.

For example, $10,000 growing at 5% per year would be worth approximately $12,800 after five years. But if you invested an additional $100 per month during that five-year period, your portfolio would grow to nearly $20,000.

Rate of Return

When you’ve decided on your starting balance, contribution amount and contribution frequency, you’re putting your money in the hands of the market. So how do you know what rate of return you’ll earn? Well, the SmartAsset investment calculator default is 5%. That may seem low, but let us explain.

When we figure rates of return for our calculators, we’re assuming you’ll have an asset allocation that includes some stocks, some bonds and some cash. Those investments have varying rates of return, and experience ups and downs over time. It’s always better to use a conservative estimate for your rate of return so you don’t under-save.

The S&P 500, which comprises 500 of the largest U.S. companies, had an average annual return of 10.68% between its launch in 1957 and the end of November 2025 (dividends reinvested). After adjusting for inflation, its average annual return drops to 6.80%. Past performance doesn’t guarantee future results, but it can help inform how you invest today.

Meanwhile, bonds have historically offered lower average annual returns, ranging from 3% to 5%, depending on the bond index. Real estate often falls somewhere in the middle. According to CEIC Data, housing prices in the U.S. increased by an average of 5.4% per year between March 1992 and December 2024.

Years to Grow

The last factor to consider is your investment time frame or time horizon. Consider the number of years you expect will elapse before you tap into your investments. The longer you have to invest, the more time you have to take advantage of the power of compound interest. As the saying goes, “It’s about time in the market, not timing the market.”

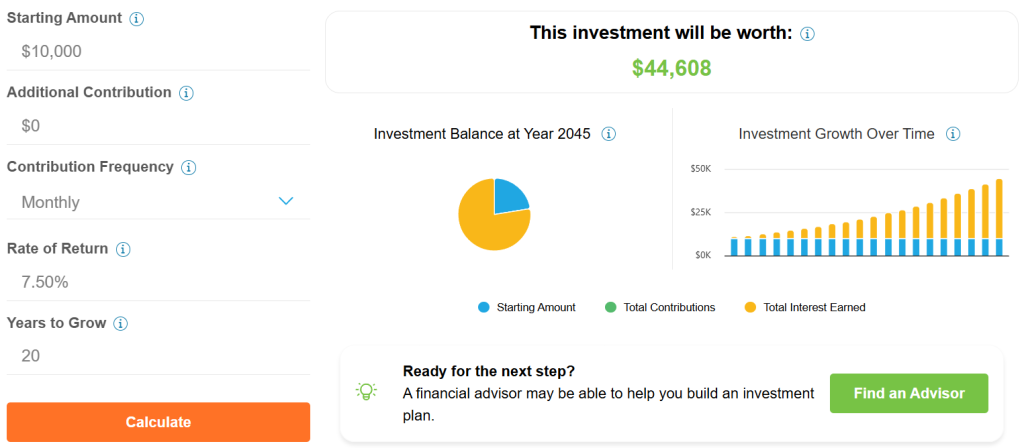

For example, if you invest $10,000 and realistically expect to earn a 7.5% rate of return each year, your investment would be worth more than $21,000 after 10 years. But if you extend your time horizon and leave the money invested for longer, 20 years for example, it could grow to nearly $45,000.

Also keep in mind that your time horizon may impact your expected rate of return. For example, if you invest the $10,000 into an S&P index fund and expect it to grow by 10.68% by the end of one year, you may be disappointed. Remember, the 10.68% annual return cited above is the annual average from a timeline of nearly 70 years.

Stocks are volatile, and returns can vary significantly from year to year. The index finished 2022 down 18%, but bounced back in 2023 and 2024 posting gains of 26% and 25%, respectively. However, the longer you keep money invested, the more time it has to potentially recover from losses.

Types of Investments

When it comes to choosing how to invest your money, you have a variety of options. Investors can choose from a range of asset classes, including stocks, bonds, funds, commodities and real estate. Here’s a look at some of the most common types of investments:

Stocks

Individual stocks are shares of a company that can increase in value as a company grows. Investors add them to their portfolios when they are prepared to take on additional risk in exchange for potentially higher returns.

Bonds

Governments and corporations issue bonds as a way to raise money for operations or special projects. In exchange, the issuer agrees to repay the loan, plus interest. Bonds, which are fixed-income investments, are typically less risky than stocks.

Mutual Funds

This type of asset pools money from investors to buy a collection of stocks, bonds and other securities that are bundled and offered as one investment. Mutual funds can offer investors the ability to diversify their holdings easily and conveniently without having to buy multiple securities.

ETFs

Like mutual funds, exchange-traded funds are diversified baskets of investments. Instead of a portfolio manager actively buying and selling the assets within the fund, ETFs typically passively track a particular market index, like the S&P 500. As a result, ETFs look to mirror an index instead of beat it. ETFs typically require smaller investments and also carry lower fees due to their passive nature. Furthermore, ETFs trade like individual stocks.

Commodities

Unlike stocks, bonds or investment funds, commodities are raw, tangible materials like gold, oil, grain and livestock. The value of commodities often hinges on supply and demand. In addition to purchasing the physical asset, you can invest in commodities through futures contracts, commodities funds and buying stock in companies that produce them.

Real Estate

Real estate is another popular asset class that comprises residential and commercial properties, as well as land. Investors typically look for a return on their investment through the appreciation of a property’s value and/or rental payments. Like commodities, investors can invest in real estate directly by purchasing physical property or indirectly through real estate investment trusts (REITs) or other partnerships.

How to Calculate Return on Investment

Return on investment, or ROI, measures how much money you can make on a financial investment like a stock, mutual fund, index fund or ETF. You can calculate the return on your investment by subtracting the initial amount of money that you put in from the final value of your financial investment. Then, you would divide this total by the cost of the investment and multiply by 100.

For example, imagine purchasing $10,000 in shares of a particular stock and eventually selling those shares for $15,000. Your ROI would be 50% according to the following calculations:

- $15,000 – $10,000 = $5,000

- $5,000 ÷ $10,000 = 0.5

- 0.5 x 100 = 50% ROI

ROI measures profitability, but it’s too simplistic to account for how long you hold an investment. Depending on your time horizon and other financial needs, this is something you should keep in mind when planning your investments or evaluating their performance.

Reasons to Invest

There’s no single reason to invest your money, but several key ideas help explain why people put their money into the market.

The potential for growth is the primary reason investors accept the risks that come with investing. Cash sitting in a savings account may earn a small amount of interest, but over time, inflation erodes its purchasing power.

For example, the Federal Reserve targets a 2% annual inflation rate. That means your money needs to grow by more than 2% per year to maintain its purchasing power. Investing gives your money a chance to grow faster than inflation, helping preserve and potentially increase its value. Of course, inflation can be much higher than 2%, as we saw in 2022 when the inflation rate averaged 8% for the year.

Investing is also one of the most reliable ways to build wealth over time and pursue long-term goals. While investing comes with risk, that risk can be managed by choosing a mix of assets that align with your goals and time horizon.

Finally, investing lets your money work for you. Through compound growth, even small amounts invested consistently can grow into significant sums. Many people invest not only to beat inflation or reach goals but to benefit from time and compounding.

Frequently Asked Questions

What Rate of Return Should I Use in the Calculator?

There’s no single “correct” number. Many people use long-term stock market averages (around 6%–8% after inflation) for equity-heavy portfolios or lower figures for conservative mixes. Your chosen rate should reflect your risk tolerance and investment strategy.

How Does Compound Interest Affect My Results?

Compound interest reinvests each period’s earnings back into the balance. This creates a snowball effect where interest itself begins earning interest. The longer your time horizon, the more compounding influences your ending balance.

Does the Calculator Account for Taxes or Fees?

Most investment calculators show pretax, no-fee projections. Taxes, advisory fees and fund expenses can reduce actual returns. Adding a more conservative return rate can help approximate these costs.