First National Bank offers average interest rates on its bank accounts. The highest interest rates are attached to the bank’s certificates of deposit. For other accounts, you’ll need to maintain higher balances to earn at a higher interest tier. If you’re simply looking for a bank that will let you earn at the highest interest rate possible, you will want to look at some of First National’s competitors.

The bank has a wide variety of online and mobile banking offerings, making banking more convenient. You’ll often need to meet a minimum deposit requirement, though, if you open an account online instead of visiting a branch. The bank only has branches and ATMs in Maryland, North Carolina, Ohio, Pennsylvania, South Carolina and West Virginia. This is something to keep in mind if you value in-person banking or hoped to open your account at a branch.

Products Offered

| Product | Key Details |

| Savings Account |

|

| Certificates of Deposit |

|

| Money Market Accounts |

|

| Checking Accounts |

|

| IRAs |

|

First National Bank Interest Rate Comparison

First National Bank Overview

First National Bank got its start in 1864 as the First National Bank of West Greenville. The bank is now headquartered in Pittsburgh and has expanded its physical presence, with hundreds of branches and ATMs in Maryland, North Carolina, Ohio, Pennsylvania, South Carolina and West Virginia.

FNB offers a number of financial products in consumer banking, commercial banking and wealth management. This means you can get a small business checking account, a student bank account and asset management all with the same bank.

First National Bank Account Features

First National Bank seeks to make your banking experience a more personal one. So while residents of only six states have access to a physical branch, you can still find convenience and help over the phone and online.

When you bank with First National Bank, you’ll have free access to online, mobile, text and telephone banking. Online and mobile banking offers services like paying bills, transferring money, making electronic payments and depositing checks on your mobile device.

Compare First National Bank to Other Competitive Offers

FirstRate Savings Account

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Savings Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $5 monthly fee, waivable with a minimum account balance of $500 |

| Current Terms and Rates |

|

The FirstRate Savings account offers a simple way to save. You can start saving with any amount when you open the account at a branch. You do have the option of opening an account online, too. You just need at least $50 to open online.

The interest rates with this account aren’t the highest, but it’s notable that it has balance tiers as a simple savings account. This means that with a much higher balance, you can earn at a better interest rate.

You can easily access your funds in this account with a debit card. You can also choose to have your statements mailed either quarterly or monthly.

Health Savings Account

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $20 annual fee, waived for existing personal checking account holders |

| Current Terms and Rates |

|

Health savings accounts, or HSAs, offer a way to save for medical expenses that aren’t covered by insurance. Plus, when you take distributions from the account, they’re tax-free when used for medical expenses. You can access this account through check writing, a debit card or online.

This account also earns interest based on account balance tiers. Luckily, to earn a higher rate doesn’t require an astronomical amount. You can open this account for an individual or for a family.

Certificates of Deposit (CDs) and Savers Goal CD

| Key Features | Details |

| Minimum Deposit | Savers Goal CD: $100, Non-Special Certificates of Deposit: $500 |

| Access to Your CD | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None, although you may face penalties for early withdrawal. |

| Current Terms and Rates |

|

Certificates of deposit offer a more structured savings account and often higher interest rates. You can typically make only one deposit into a CD when you open the account. After that, you cannot touch the account until it reaches maturity, or the end of the term length you’ve chosen. At that time, you’ll have a grace period to withdraw your funds. If you don’t take any action, the account will automatically renew for the same term length and at the current interest rate.

The bank has a few different options when it comes to CDs. There is the 12 Month Savers Goal CD, which has a lower minimum deposit requirement and earns at a solid interest rate. All other CDs in this section require a higher minimum deposit of $500. These CD terms also offer decent interest rates. Plus, you can open these CDs as IRAs.

Interest on a First National Bank CD is compounded quarterly and can be credited to your certificate, paid by check or credited to another First National Bank account.

Special CD Offers

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your CD | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None, although you may face penalties for early withdrawal. |

| Current Terms and Rates |

|

These Special CD Offers earn at much higher rates than the bank’s regular CDs. However, these accounts have much longer term lengths. This means you’ll have to wait from 13 months to 10 years to access the funds inside the account. However, you can choose to have the interest credited to your certificate, paid by check or credited to another First National Bank account.

The 10-year CD is not available as a fixed rate IRA. The 13-month and 19-month CDs are not available for public funds or for rollovers/transfers from other FNB deposit accounts.

FirstRate Money Market Account

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Money Market Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $10 monthly fee, waivable with a minimum account balance of $5,000 |

| Current Terms and Rates |

|

Money market accounts offer features from both savings and checking accounts. The FirstRate Money Market Account earns according to balance tiers, with rates slightly higher than the basic savings account. Plus, you’ll have the ability to write checks and use a debit card with this account.

Freestyle Checking Account

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Checking Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

True to its name, the Freestyle Checking account offers its perks and services at no extra costs. For starters, there is no monthly fee and you can receive free eStatements with check images. (If you choose to receive paper statements, you will see a charge for that.) You also gain unlimited check writing and deposits, although you don’t receive the checks for free.

Of course, you’ll have free access to a Visa® Debit Card, online banking, mobile banking, telephone banking and bill pay.

Lifestyle Checking Account

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Checking Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $10 monthly fee, waivable with one of the following

|

| Current Terms and Rates |

|

The Lifestyle Checking Account is one of two FNB checking accounts that earns interest. You do have to maintain a balance of at least $2,500 to earn interest, though. You can have balances lower than that amount, of course. If anything, you’ll want to meet the minimum of $1,000 to waive the monthly fee.

This account still includes a free first order of FNB Custom Checks, free eStatements with check images, free paper statements option and a free safe deposit box.

Premierstyle Checking Account

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Checking Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $25 monthly fee, waivable with one of the following

|

| Current Terms and Rates |

|

First National Bank’s Premierstyle Checking Account earns interest at tiered rates. So with higher balances, you have the opportunity to earn at higher rates. These rates even come higher than the basic savings account’s top tier. You will need at least $1,000 to start earning interest. However, you will need a much higher balance to waive the monthly fee.

Owning this checking account provides a number of free perks. This includes a safe deposit box, overdraft line of credit/overdraft protection, eStatements or paper statements, two incoming domestic wire transfers per statement cycle, stop payments, custom checks and financial analysis review. You can also avoid non-FNB ATM fees and receive up to $15 in ATM fee refunds.

FNB-U Student Banking Package

| Key Features | Details |

| Minimum Deposit | $50 to open online, $0 to open in branch |

| Access to Your Account | Online, mobile, over the phone and at physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

The FNB-U Student Banking Package is designed to make banking easy for busy students. Students don’t have to worry about a monthly fee, maintaining a minimum balance or check writing and deposit limits. Students also receive their first order of checks for free and two fee refunds for non-FNB ATMs per statement cycle.

Where Can I Find First National Bank?

You can find First National Bank online, on mobile, over the phone and at a physical branch. The bank has over 400 branches and 550 ATMs in the following states: Maryland, North Carolina, Ohio, Pennsylvania, South Carolina and West Virginia. You can still bank with FNB if you don’t live in these states. However, it may make your banking experience more convenient to have a branch nearby.

What Can You Do Online With First National Bank?

You can complete all your banking needs online with First National Bank. You can start by browsing the bank’s offerings like its bank accounts or residential mortgages right from the homepage, shown here. Then if you’re ready to open an account, you can just as easily do so online by clicking the “APPLY NOW” button for the account you’ve chosen.

Once you have an account, you can go online to check balances and transactions, transfer funds, pay bills, use the bank’s budgeting tools, locate branches and more.

You can do the same on mobile with the bank’s mobile app or on your mobile browser. You can also deposit checks through your mobile app.

How Do I Access My Money?

You can access your money online, on mobile, over the phone or at a branch/ATM. To access your money at a branch or ATM or over the phone, you’ll need your debit card and/or account information.

To access your money online or on mobile, you’ll need to enter your online banking User ID and password. You can even choose your destination when you log in, whether you want to go straight to your account overview, summary, transfer page or bills page.

How Can I Save More Money With a First National Bank Account?

You stand to save more by opening a First National Bank CD. These accounts have the highest rates, especially longer-term CDs. The only catch to this is that you have to wait a while (over a year) to have access to your funds. Outside of CDs, you’ll find better interest rates with the money market account.

Some FNB accounts earn interest according to account balance tiers. This means you can earn more by having higher balances. You can also save more by meeting certain requirements to waive an account’s monthly fee.

What’s the Process for Opening an Account With First National Bank?

You can open all the above bank accounts online, except the Health Savings Account. It’s important to remember that you’ll need at least $50 to open most accounts online. You won’t need any money to open those accounts at a branch, though.

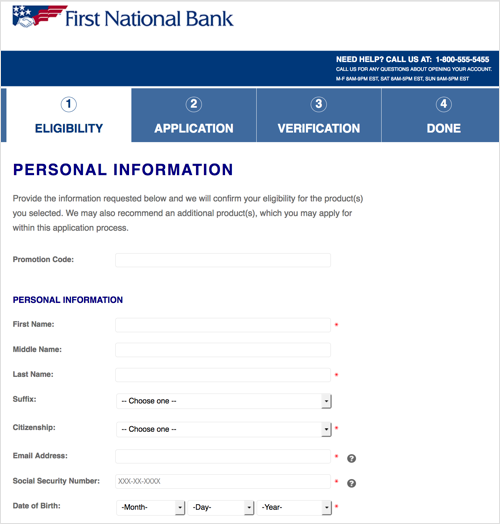

If you’re applying online, you can start the process by clicking the “APPLY NOW” button for the account you want to open. You will then be taken to the webpage shown here. There, you'll provide your information like home address, phone numbers, employment status and more.

The bank’s website does not list the fees for a few of the above accounts. You may want to call the bank before you open an account to make sure you have the most recent fee and rate schedule.

What’s the Catch?

The catch to banking with FNB is that you won’t have access to the industry’s highest interest rates. The bank’s basic savings account offers the lowest possible interest rate for its first balance tier. You’ll need to have a pretty high balance in order to earn at a slightly higher rate (that still falls under the national average).

There is also the catch of having a higher minimum deposit requirement when you open an account online. So if you want to open the account online, but only have $25, for example, you’ll need to visit a branch to do so.

Finally, the bank only has branches in six states, Maryland, North Carolina, Ohio, Pennsylvania, South Carolina and West Virginia. You can still open an account and bank with FNB outside of these states, but you won’t have access to the features that come with a physical branch.

Bottom Line

First National Bank offers some decent interest rates on some of its bank accounts. Its simple savings account doesn’t earn much, especially on lower account balances. However, you can snag much more favorable interest rates when you open a FNB certificate of deposit. The longer the term, the higher the rate will be. Other accounts require higher balances for better rates.

The bank also charges monthly fees for certain accounts. While you can have these fees waived, you’ll have to meet certain requirements like higher account balances or a certain number of transactions.