Online will-writing and estate planning platform DoYourOwnWill.com boasts features that cover a wide variety of will-related situations. Surprisingly, you won’t have to pay anything to take advantage of what the company offers. By the same token, DoYourOwnWill is relatively basic, and those with more complex estate planning needs may want to look elsewhere. DoYourOwnWill also doesn’t provide access to customer support if you run into any issues along the way.

Consider working with a financial advisor if you need help making a plan for your assets. Connect with an advisor today.

| DoYourOwnWill.com Overview | |

|---|---|

| Pros | – Completely free service – Simple and easy to understand |

| Cons | – Lacks some of the in-depth services of its competitors – Minimal customer service |

| Best For | – Those with minimal estate planning experience |

DoYourOwnWill.com: Services and Features

DoYourOwnWill is a simple, easy-to-use service available to anyone with access to a web browser. While you may need to look elsewhere if you have complicated estate planning needs. That said, DoYourOwnWill actually covers more situations than you might expect.

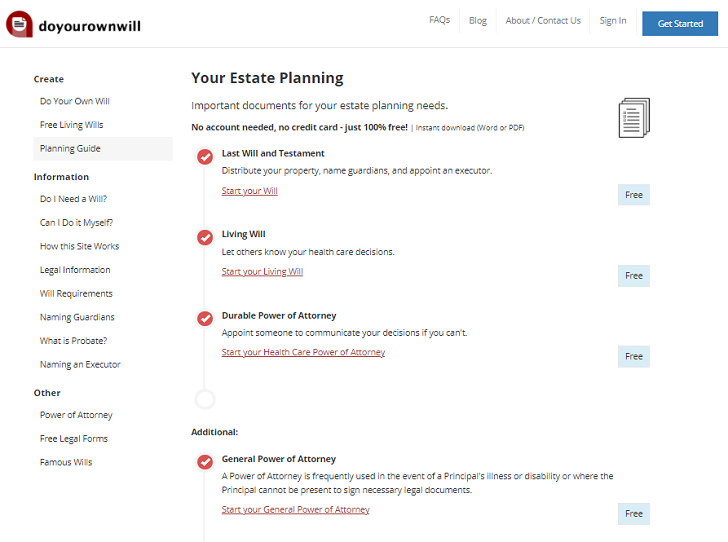

Here’s what you’ll have access to when you use this free platform:

- Last wills and testaments

- Simple trusts

- Bequests

- Memorial preferences

- Living wills

- Durable and general power of attorney

- Digital asset management

- Pet guardian trusts

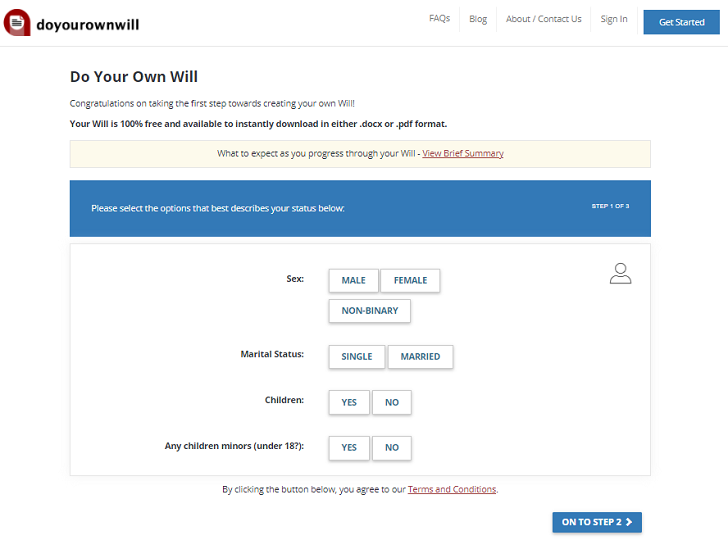

To take advantage of this company’s features, all you need to do is go to DoYourOwnWill.com and start the process of opening an account. From beginning to end, creating your will takes only about 15 minutes, and it won’t cost you any money. However, those interested in broader estate planning may want to use a separate service.

It’s fair to ask how DoYourOwnWill operates as a free service. Well, the website earns revenue from advertisements and affiliate relationships, so you won’t have to worry about pesky fees that arise once you complete your will. In fact, once you finish creating your will, you can simply download it as a PDF.

One drawback of using DoYourOwnWill is that the platform doesn’t offer phone or chat support. However, email support is available if you need it. While you don’t need an account to use the platform, it’s a good idea to make one so you can go back and change or update your will when needed.

DoYourOwnWill.com: Pricing

DoYourOwnWill.com is completely free, unlike almost every other platform that exists for will-writing or estate planning. Instead of a membership or per-service price model, the site makes its money from affiliate partnerships and advertising. There are no hidden fees, so you won’t see unexpected charges before you download your will.

DoYourOwnWill.com: Customer Support

Perhaps the single biggest drawback of DoYourOwnWill.com is the fact that you won’t have convenient access to customer support when you have a question. This means you can’t call support or chat with a representative. You can contact support by email, but responses may take longer than phone or chat would.

To help you through these times, DoYourOwnWill has informational resources available. However, the company states the following on its website: “Because we are not a law firm, we cannot provide legal advice and any questions regarding legal advice or estate planning must be directed to a qualified attorney.”

DoYourOwnWill.com: Online Experience

DoYourOwnWill.com is incredibly simple and straightforward to use. To get started, just go to DoYourOwnWill.com on your computer or mobile device and begin following the instructions. There are informational resources along the side of the screen, and you can also read through frequently asked questions and the company’s blog.

DoYourOwnWill.com’s homepage gives you two options: “Start Your Will” or “Browse Documents.” The former starts you on the 15-minute process of creating your will by asking a series of questions. The latter shows you a number of other options, such as guardianships, living wills and power of attorney, which you can create just as easily. At the end of the process, you can download a PDF of your documents. It’s as easy as that.

How Does DoYourOwnWill.com Stack Up?

DoYourOwnWill.com stacks up pretty well, especially considering it’s free to use. Despite this, it still provides significant value when compared to its much more expensive competitors.

Note that there are two areas in which DoYourOwnWill is lacking a bit. First, you won’t have any access to customer support if you have questions about your situation. Second, DoYourOwnWill is for simple wills and estate planning documents. If you have a complicated or large estate, or if you need help with a wider range of services, you may find the platform to be inadequate.

| Comparing DoYourOwnWill.com to Other Services | |||

|---|---|---|---|

| Service | Pricing | Features | Accessibility |

| DoYourOwnWill.com | – Free | Wills and living wills – Guardianship – Simple trusts – Bequests – Memorial preferences – Power of attorney (durable and general) – Digital assets | – Web-based program |

| Trust & Will | – Will: $199 ($299 for couples) – Trust: $499 ($599 for couples) | – Guardian membership – Will membership – Trust membership | – Web-based program |

| Rocket Lawyer | – $39.99/monthly membership; $239.88/annual membership – With no membership, services available for a separate cost – Free seven-day trial for will making | – Sessions with a lawyer – Custom legal forms – Online Q&A with lawyers – Document defense – Form an LLC, corporation or non-profit – Registered agent service | – Web-based program |

Bottom Line

DoYourOwnWill.com is a great option for most when it comes to writing a will and creating some other estate planning documents. The platform is easy to navigate and understand, and you’ll receive a clear PDF of your documents after as little as 15 minutes of answering questions and entering information. Although it lacks some services and support offered by competitors, DoYourOwnWill remains a viable option for many starting their estate plan.

Tips for Estate Planning

- Estate planning can be confusing, so it pays to have a helping hand. That’s where a financial advisor can potentially help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- You may want to create a living will or another form of advanced directive to ensure that your doctors and loved ones comply with your choices at a time when you are unable to make decisions for yourself. This is an often forgotten, but important part of estate planning.

Photo credit: ©iStock.com/gradyreese, DoYourOwnWill.com