Founded in 1946 and headquartered in Boston, Fidelity is a global financial services company with more than $16.4 trillion in assets under administration. With its full suite of products and services, investors can choose from investments like annuities, mutual funds, retirement plans, 529 plans and exchange-traded funds (ETFs). In addition to its brokerage arm, Fidelity offers investment services through a robo-advisor called FidelityGo and its hybrid robo-advisor, Fidelity Personalized Planning and Advice. There is also a financial advisor division, Fidelity Investments, for anyone who wants a full-service wealth management experience. Our Fidelity review dives into the intricacies of Fidelity as a whole, examining its services, fees and user experience to help you determine whether it is the right fit for you.

If you prefer a hands-on approach to investing, a financial advisor can help you create a financial plan for your needs and goals.

Fidelity Overview

| Pros | Fidelity index mutual funds with zero expense ratioNo trading fees for U.S. stocks, ETFs and optionsNo minimums to open an account$0.65 per contract on options |

| Cons | Tools and research may overwhelm newer investorsNo paper tradingNo futuresCrypto not available everywhere |

| Fees | No annual account fee$0 on all U.S. stocks, ETFs and optionsZero expense ratios for four Fidelity index funds |

| Minimum Balance | $0 (some investments may require minimums) |

Who Fidelity Is Best For

Fidelity is best for experienced investors who want to actively manage their investments. The zero cost of U.S. stocks, as well as ETFs and options, makes this brokerage an appealing option for frequent traders rather than those who buy and hold their investments.

On the other hand, the lack of a minimum investment for some indexed mutual funds could also be attractive to investors who want a more passive investing strategy with lower risk. Still, it is helpful to have at least some experience in investing before using a Fidelity brokerage account.

Drawbacks of Using Fidelity

Fidelity offers extra incentives when you choose Fidelity products, such as no fees on several Fidelity and iShares mutual funds, while you pay $49.95 per purchase of non-Fidelity funds that have a transaction fee. Keep in mind that the $49.95 fee will also apply if you redeem your fund less than 60 days after purchase.

Fidelity also lacks some services. No futures are available, and cryptocurrency is not available in every state. Additionally, beginner investors will not be able to practice their investment skills with paper trading, as this is a feature Fidelity does not offer.

If you want access to these products and features, consider another one of the best brokerages. For example, E*TRADE offers futures, while Robinhood specializes in cryptocurrency. If you are a new investor wanting to build your skills, consider Charles Schwab or Webull for paper trading.

Fees Under Fidelity

In 2019, most major brokerages cut their commissions on U.S. stock and ETF trades to $0, Fidelity included. Additionally, Fidelity offers purchases of new issue bonds and some U.S. Treasuries at no cost. It does not charge a fee for non-Fidelity mutual funds if there is no transaction fee associated.

| Type of Fee | Cost |

| Commissions | |

| Online U.S. equities | $0 |

| Online options trades | $0 per trade, plus $0.65 per contract |

| Online ETF trade | $0 |

| New issue bond | $0 |

| Secondary issue bonds | $1 per bond |

| U.S. Treasury auctions and secondary issues online | $0 |

| U.S. Treasury auctions and secondary issues representative assisted | $19.95 flat fee |

| Fidelity mutual funds: $0 | $0 |

| Non-Fidelity funds | $0 ($49.95 on redemption if held less than 60 days) |

| Non-Fidelity funds transaction fee | $49.95 per purchase |

| Depository Foreign Trust Company foreign settlement fee | $50 per trade |

| Stock certificate transfer and shipping | $100 per certificate |

| Foreign dividends and reorganizations | 1% of principal per transaction |

| Margin liquidation | $32.95 per liquidation |

| Money Transfer Fees | |

| ATM fees | Full reimbursement |

| Electronic Funds Transfer | $0 |

| Check copies | $0 |

| Fidelity BillPay | $0 per transaction |

| Maintenance Fees | |

| Electronic statements | $0 |

| Monthly statements | $0 |

| Trade confirms | $0 |

| Debit card annual fee | $0 |

| Mutual fund annual low balance fee | $0 |

Fidelity Features and Services

Fidelity offers a number of brokerage accounts and services, including a generous selection of investment types and financial advisory services.

The core product that Fidelity offers is its trading account. With this, you can invest in stocks, mutual funds and other types of securities. It is simple to manage your investments with comprehensive charts illustrating your portfolio’s performance over different periods of time to see if your portfolio needs rebalancing. You can then adjust your asset allocation as needed.

Fidelity also offers a number of research and educational tools that can help you with this. There are more than 20 years of data available for you to mine, plus the option to test your strategy and see if it is likely to produce your desired returns. There are also a number of articles and webinars you can use to brush up on your knowledge.

Another important service the company offers is its cash management account. This can effectively replace a traditional checking account from a bank. It allows you to have all of your assets, including cash and investments, under the same umbrella. As part of this service, Fidelity will reimburse any ATM fees that you pay to other banks.

Beyond these services, Fidelity also offers a number of retirement accounts. These include several types of individual retirement accounts (IRAs), including Roth IRAs, SEP-IRAs and individual 401(k) plans. It also offers 529 college savings plans.

If you need prefer personalized guidance, Fidelity also offers access to financial advisors through Fidelity Wealth Management. Fidelity also offers a robo-advisor and a hybrid robo-advisor for investors who prefer a more passive investment strategy.

Fidelity Services and Features

| Feature or Service | Details |

| Account types | Traditional IRAs Roth IRAs RA rollovers Self-employed 401(k) 529 college savings plans Life insurance Brokerage trading accounts Forex Cryptocurrency Cash management Business accounts Managed accounts Trusts Estates Annuities |

| Investment Research Tools | Up to 20 years of historical data Strategy testing Company profiles |

| Educational Research Tools | Articles Webinars |

| Special Offers | No-load mutual funds No-transaction fee on some Fidelity funds |

| Customer Service | 24/7 Fidelity virtual assistant Live chat (limited hours) 24/7 Phone support |

Fidelity Online Experience

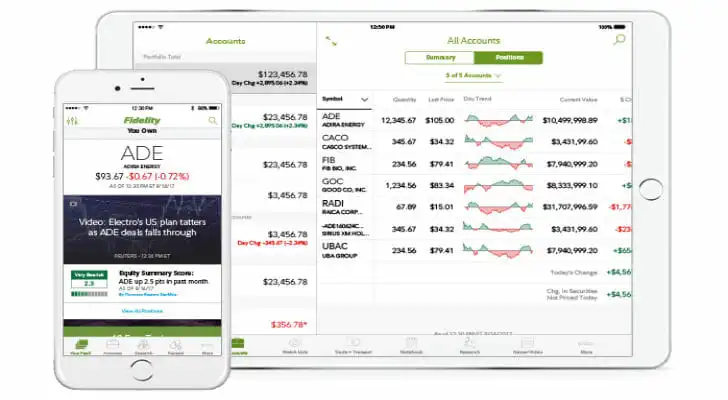

Fidelity offers a robust online experience for those who want to trade on their desktop. You can look at a variety of data and use tools like the recently revamped Active Trader Pro. This allows for greater customization and a streamlined trading process. Users can access Level 2 quote data with in-depth charting capabilities and multiple indicators. There is even multi-monitor support, so you do not miss a single detail. If you want to see a company’s investment before deciding whether to invest, you can check the company’s summary page to see its history and make an informed decision.

With Fidelity’s platform, you can also check your account anytime to track investment performance. This will also help you decide the right time to rebalance your portfolio.

Fidelity Mobile Experience

If you prefer to do your trading on the go, Fidelity’s mobile app is available on Apple and Android devices. Fidelity’s app averages 4.8 out of 5 stars in the App Store, where it ranks 31st among all finance apps. On Google Play, it earns a 4.6 rating.

You can make trades and access all the same research and data you will find on the desktop version. However, the mobile app allows you to set up customizable push alerts that will notify you when market shifts or other events occur. There is also a notebook feature where you can take notes or write down ideas you have for investing.There are many other features available on the mobile app. For instance, you can see an overview of your account or research a specific stock you are considering. You can even set up a watch list to monitor stocks you want to track.

Fidelity Customer Support

Fidelity offers several ways to contact customer service. One option is to use the company’s automated virtual assistant. There is also live chat available Monday through Friday from 8 a.m. to 10 p.m. ET and Saturday through Sunday from 9 a.m. to 4 p.m. ET.

Phone support is also available 24/7 when you call 800-343-3548.. When you use the Fidelity mobile app, you can click a single button and automatically connect with a Fidelity representative.

If you want to speak to someone in person, you can visit a Fidelity investment center in person. Fidelity has a convenient branch locator tool you can use to find the nearest location to your home.

How Does Fidelity Compare?

Fidelity is one of the best brokerages today, but it is far from the only one. This is a quick snapshot of what to consider when comparing Fidelity vs. Schwab vs. Robinhood.

Fidelity vs. Merrill Edge vs. Robinhood

| Brokerage Firm | Trading Fees | Minimum | Best For |

| Fidelity | $0 | $0 | Experienced tradersThose who want to make frequent trades |

| Charles Schwab | $0 | $0 | Newer investors who want 24/7 customer supportThose who prefer in-person advising at physical branches |

| Robinhood | $0 | $0 | Mobile/online tradersSelf-sufficient investors |

When choosing which brokerage to use, be sure to compare important factors like trading fees and account minimums. Also, review the desktop and mobile platforms to ensure they offer the right features and layout that you need.

Fidelity Robo-Advisors and Digital Tools

Fidelity offers a popular automated investing platform for professional portfolio management without the cost of full-service advising: Fidelity Go.

Fidelity Go is the firm’s pure robo-advisor. It builds and manages a diversified portfolio of Fidelity Flex mutual funds based on your financial goals, time horizon and risk tolerance.

Fees are also competitive.

Fidelity Go Fees

| Balance | Fee |

| Under $25,000 | $0 |

| $25,000 + | 0.35% annually |

This makes Fidelity Go one of the more affordable robo-advisors, especially for those with higher balances, compared to Betterment or Wealthfront, which typically charge around 0.25% annually across all tiers.

The platform offers automatic rebalancing, tax-efficient strategies and integration with Fidelity’s broader suite of accounts. However, unlike Vanguard’s Digital Advisor, Fidelity Go does not offer direct integration with non-Fidelity funds, and unlike Schwab Intelligent Portfolios, it does not require holding excess cash in your portfolio.

These robo-advisor tools make Fidelity appealing for investors who want hands-off management. However, they are not a replacement for a full-service financial advisor if you need comprehensive wealth planning or estate strategies.

Fidelity Disclosures

Fidelity has 147 disclosures on its record, according to FINRA BrokerCheck. This includes 23 regulatory events and 124 arbitrations.

The most recent regulatory event was in January 2025. Fidelity was fined $600,000 for its failure to provide proper security precautions to protect user data.

Just three years prior, in January 2022, Fidelity was fined $750,000 when it was accused by the Massachusetts Securities Division of “unethical and dishonest conduct” and failure to comply with the Massachusetts Uniform Securities Act.

Bottom Line

Fidelity’s brokerage arm offers zero or low fees for stock and options trades with a big selection of in-house mutual funds and ETFs – many of which are available at no commission. Investors can also enjoy a robust suite of research and investment tools and an intuitive, well-reviewed mobile investment app for investing on the go.

In general, Fidelity is better for more experienced investors and those who want to invest in mutual funds and ETFs from the Fidelity family of products. However, it does have some disclosures that current and potential clients should note. Before making a decision, be sure to review fees, browse platforms and check Fidelity reviews from current users to ensure it is the right brokerage for you.

A financial advisor can help you determine how to set up your portfolio to grow wealth and meet your future financial goals.

Tips for Finding a Financial Advisor

- A brokerage account is good if you want to do your investing yourself, but if you want more help then you might want to consider finding a full-service financial advisor. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- When you do talk to a financial advisor, make sure to know which questions to ask. It’s important to ask the right questions so you can figure out if the advisor is the right person to guide your financial life.

Photo credit: Fidelity.com