Hiring someone to care for your loved one so you can continue working is a common practice in the U.S. If a child, spouse or other household member requires care and you can’t provide the care without quitting your job, you’re not alone. Depending on your situation, you may be eligible to claim a tax credit to defray the expenses associated with that care.

A financial advisor can potentially help you optimize your tax strategy to meet your household needs and financial goals. Find a fiduciary advisor today.

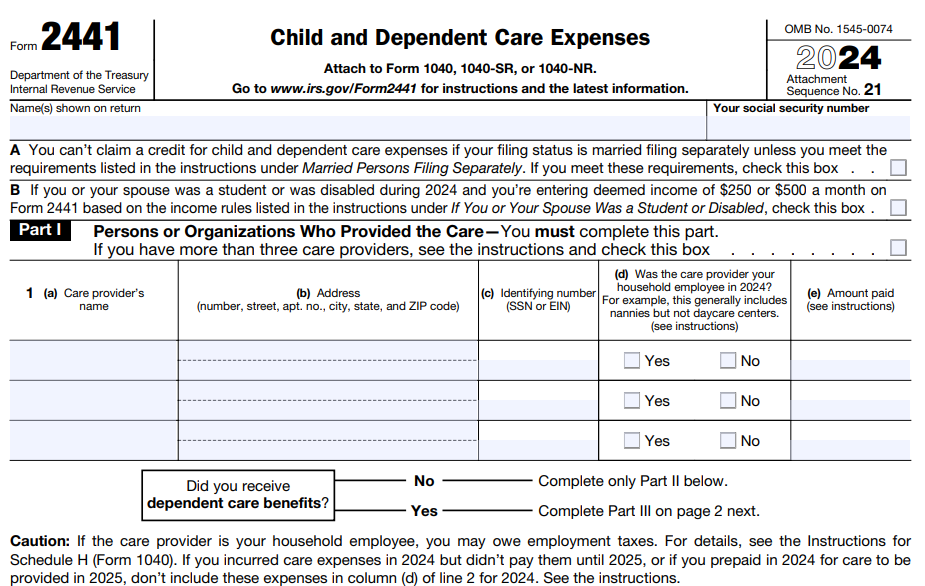

IRS Form 2441: Child and Dependent Care Expenses

IRS Form 2441, Child and Dependent Care Expenses, is a two-page form used to claim a tax credit for eligible care costs. It can take time to complete accurately, and the credit may not cover all of your expenses.

For 2026, the credit is capped at $3,000 for the care of one person and $6,000 for two or more. These limits remain the same, but the percentage of expenses you can claim depends on your adjusted gross income.

Who Qualifies for the Child and Dependent Care Credit?

To qualify for the Child and Dependent Care Tax Credit, you must meet certain eligibility requirements. Most importantly, you must have paid someone else to provide care so that you could work or look for work.

The care you paid for must have been for a dependent child under age 13 or for a spouse or other household member (who you could claim as a dependent) who is physically or mentally incapable of self-care. If you’re filing single, you must have earned income to claim the tax credit, income reported on your Form 1040. If you’re married and filing jointly, you and your spouse must both have earned income, unless one of you was a full-time student or has a disability. With a few exceptions (such as separated spouses), couples who are married and filing separately can’t claim the tax credit.

The care expenses for which you’re claiming the tax credit must have been paid to someone outside of the household. You can’t use the credit for money you paid to your spouse, to the parent of the household member in need of care, to a dependent of yours or to your child who will not be age 19 or older by the end of the year. The first step when filling out Form 2441 is to identify the caregiver or caregivers you paid. Remember that if one or more of those caregivers worked in your home, you may be liable for nanny taxes on behalf of your household employees.

How to Fill Out Form 2441

Part I

The point of Form 2441 is to prove to the IRS that you’re eligible for the Child and Dependent Care Tax Credit, to indicate the eligible care costs you incurred during the tax year and to declare your income. In Part I, you’ll write the name(s) or the person or people who provided the care you paid for. For each caregiver you list, include their address, Social Security number(s) (or Employer Identification Number), the amount you paid, and whether the caregiver was a household employee.

Once you’ve filled out Part I, you have two choices. If you received dependent care benefits, head to Part III before completing Part II. If you didn’t receive dependent care benefits, go straight to Part II.

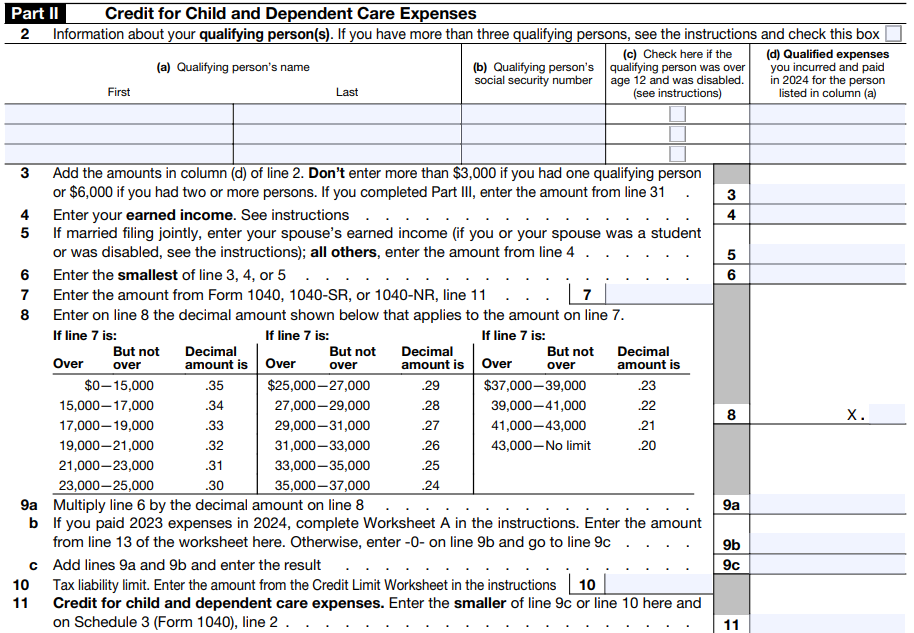

Part II

Part II concerns the credit itself and it’s where you calculate the tax credit you’re eligible to claim. First, you’ll write the name(s), Social Security Number(s) and “qualified expenses” for each person or people whose care you’ve paid for. Add up those amounts paid (if you’re claiming for more than one person) and enter the sum in Line 3 – unless you went straight to Part III, in which case you’ll write the amount from Line 31 in Part II.

Lines 4 and 5 are where you enter your own earned income and your spouse’s earned income (if applicable). Then, on line 6, enter the smallest of Lines 3, 4 or 5. On line 7, enter the amount from Form 1040 or 1040NR line 11, your adjusted gross income (AGI). On line 8, use the chart to find the decimal amount that corresponds to what you wrote in Line 7. On line 9, multiply Line 6 by the decimal from Line 8.

This is where you reduce your allowable credit by a percentage that varies based on your income. People with lower incomes get to keep more of their credit. On line 10, enter your tax liability limit from the attached worksheet. On Line 11, enter the smaller of Line 9 or Line 10. You should also write your Line 11 result (the credit itself) on line 2 of Schedule 3 (part of your complete Form 1040 package). And that’s Part II finished. Line 11 shows you your credit.

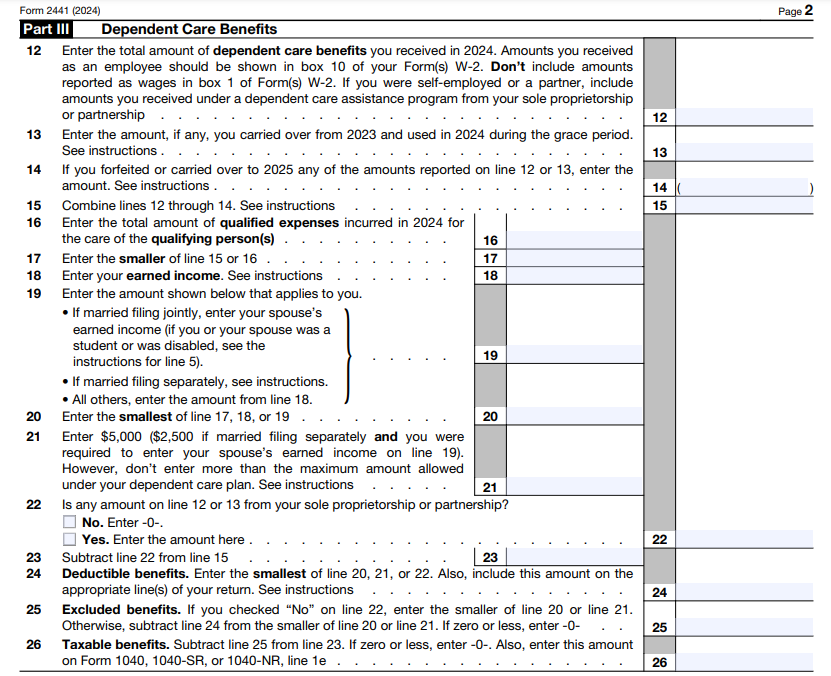

Part III

If you received dependent care benefits, you will have skipped to Part III. What are dependent care benefits, you ask? They’re the benefits an employee gets from an employer to cover child or other dependent care expenses. Those benefits can take the form of a stipend, the fair market value of employer-provided daycare or even the money that you put into your flexible spending account (FSA) to cover care expenses.

If you received dependent care benefits, they’ll appear in box 10 of the W-2 form your employer gives you before tax time. Enter those benefits on Line 12 of Form 2441. On line 13, enter the amount of benefits you carried over from a previous year, if applicable. On line 14, enter the amount you’re forfeiting or carrying over, if applicable.

On Lines 16–26 you’ll adjust those benefits according to the instructions on Form 2441. Adjustments will be based on your income, your spouse’s income (if applicable), the type of benefits you received and your filing status. There will be instructions to help you reconcile Form 2441 with your 1040 or 1040NR.

This step helps prevent claiming the same tax benefit twice. If you received tax-free dependent care benefits, you must reduce your eligible expenses by that amount to avoid receiving both a tax exclusion and a credit for the same expenses.

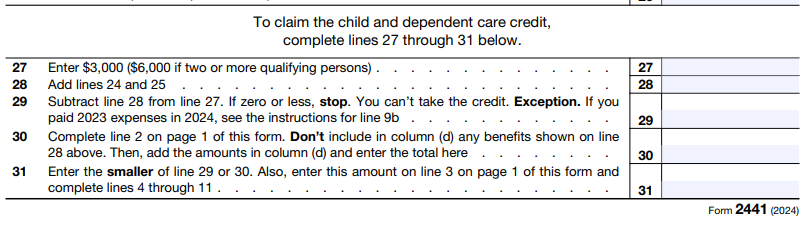

After reporting and adjusting your dependent care benefits, Lines 27–31 are used to calculate the Child and Dependent Care Tax Credit. Enter the amount from Line 31 of Part III on Line 3 of Part II, then follow the IRS instructions for Lines 4–11 to determine your credit.

Limits and Income Phaseouts

The Child and Dependent Care Credit is capped at $3,000 of expenses for one qualifying person or $6,000 for two or more. You cannot claim more than these amounts, even if your actual costs were higher. The IRS then applies a percentage to those expenses to calculate your credit. This percentage ranges from 20% to 35%, depending on your income.

Families with lower adjusted gross income get closer to the 35% rate. For example, if you have $3,000 of eligible expenses for one child and qualify for the 35% rate, your credit would be $1,050. If you qualify for the 20% rate, the same expenses would generate only a $600 credit. The formula is designed to give more help to lower-income households.

As income rises, the allowable percentage gradually phases down. Most middle- and upper-income households end up at the 20% rate, which is the minimum. That means the maximum credit most higher-income taxpayers can claim is $600 for one child or $1,200 for two or more. This reduction happens automatically when you follow the worksheet on Form 2441.

It is also important to remember that this is a nonrefundable credit. That means the credit can reduce your tax bill to zero, but it will not generate a refund by itself. If you expect large child or dependent care expenses, the credit may offset part of the cost, but it will not cover the full amount you paid.

Bottom Line

Providing care is a part of life and the IRS offers the Child and Dependent Care Tax Credit to help offset some of the costs for taxpayers who need care in order to work. For 2026, the credit allows up to $3,000 in qualifying expenses for one child or dependent and up to $6,000 for two or more, with the actual credit ranging from 20% to 35% of those expenses depending on income.

Tips for Calculating Your Taxes

- Whether you need help tax planning, investing or retirement planning, a financial advisor can help you create a financial plan for you and your family. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you don’t know whether you’re better off with the standard deduction or itemizing deductions, you might want to read up on it and do some math. Educating yourself before the tax return deadline could help you reduce your tax liability. You can also check out our income tax calculator to get an estimate.

Photo credit: ©iStock.com/goldenKB, images of Form 2441 come from IRS.gov, ©iStock.com/kdshutterman