The W-2 form is one of the most important tax forms. However, unlike many other tax forms, this is not a form you typically have to fill out yourself. Instead, your employer will complete the form and distribute it directly to you. If you are an employer who is unfamiliar with how to fill out a W-2 or you are unsure whether your employees need one, this is everything you need to know.

Working with a financial advisor may help you optimize your tax strategy and your financial goals. Find a financial advisor today.

What Is a W-2 Form?

A W-2 form, also referred to as a wage and tax statement, is a form showing how much money an employee earned for that year and the amount of taxes that employers have already paid to the IRS. If an employee made at least $600 in the tax year, they are due a W-2 by the February 2nd deadline. Even if the employee makes less than $600, that person must receive a W-2 if any income, Medicare or Social Security taxes were withheld.

Not everyone needs a W-2 form. Independent contractors and self-employed individuals need a 1099 form instead.

Have you ever confused a W-2 form with a W-4? It is a common mistake. Just remember that employers complete W-2 forms and send the completed forms to employees.

With a W-4 form, however, employees complete the forms themselves. When someone starts a new job or experiences a change in their financial circumstances or tax filing status, that person fills out a W-4 form listing their deductions so their employers know what amount of taxes to withhold.

How Many W-2 Forms Do I Need?

In total, employers produce six copies of every W-2 form. Three of those copies go to the employee. The employee then files them with their tax returns. Meanwhile, employers keep a copy for themselves.

Two copies also go to the government. One goes to the Social Security Administration (SSA), along with a W-3 form that includes a summary of all W-2s for every worker on payroll. The SSA only accepts e-filed forms, not photocopies. The other copy goes to the appropriate state, city or local tax department.

What Goes on a W-2 Form?

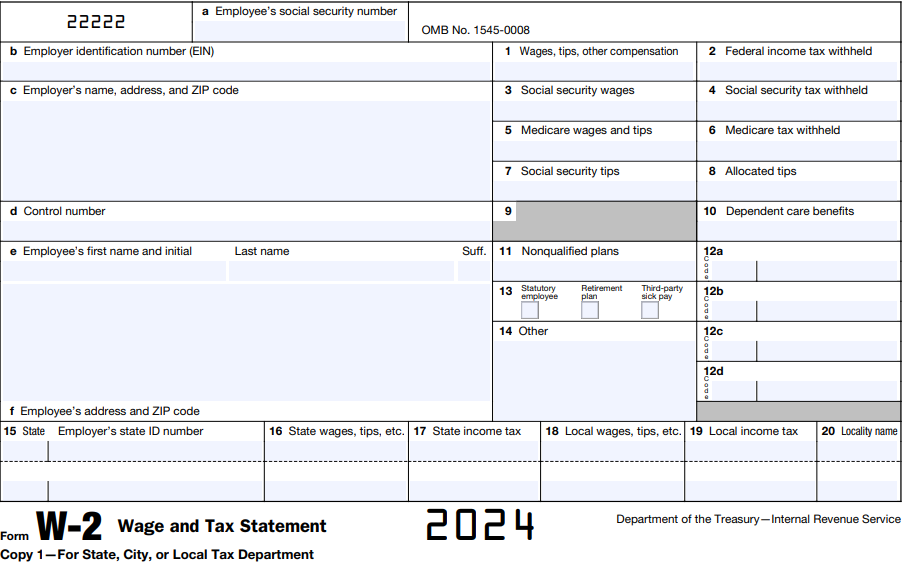

When completing a W-2 form, an employee’s Social Security number goes at the very top. Directly below that is a spot for your identification number, followed by your name and address.

There is also a control number that you may or may not use for payroll purposes. That comes right before the employee’s name and mailing address.

Boxes 1 – 10

- Turning your attention to the numbers on the right side of the form, place the employee’s annual earnings from wages and tips in box 1. Any taxes that have been withheld are included in that number, but deductions from accounts like IRAs are not.

- Boxes 2, 4 and 6 are for federal income taxes, Social Security taxes and Medicare taxes that you have paid the government over that tax year.

- If you work in the food and beverage industry, the amount of tips that your employee reports to you gets recorded in Box 7. But the actual amount they receive goes in Box 8.

- Box 9 has been blank since 2011 when the government did away with the pay-as-you-go option for the Earned Income Tax Credit (EITC). Now, eligible filers receive their EITC in one lump sum rather than over the year. Box 3 is where you indicate the amount of income that is taxed for Social Security. Do not include any tips here. Because this number reflects taxable earnings before deductions were made, it may be higher than the amount in Box 1 because Social Security cannot tax employees above a certain threshold. For 2026, this threshold is $184,500. However, there’s no cap on taxable earnings for Medicare. So the amount recorded in Box 5 just factors in wages and tips.

- If your employees receive any deductions for childcare expenses, that amount goes in box 10.

Boxes 11 – 14

- If your employee withdraws anything from a 457(b) plan or a non-qualified retirement plan, that dollar amount gets added to Box 11.

- Box 12 may take time to fill out because you must enter different codes and amounts here, depending on the benefits and additional payments a worker receives. Twenty-six codes ranging from A to Z and AA to EE are located on the back of the form for your convenience.

- In Box 13, check each box if your employee is part of your retirement plan, received sick pay from a third party or is a statutory worker. Independent contractors count as statutory employees in certain situations, including when a full-time salesperson mainly works for one company.

- Any other deductions that have been left out can be written in Box 14. Examples include tuition assistance and union dues.

Boxes 15 – 20

- Write your state and employer state ID number in Box 15 if your state requires you to do so.

- Box 16 is for an employee’s total earnings that are subject to state income tax withholding.

- Box 17 indicates the total state income tax amount withheld.

- All income eligible for local taxation must be placed in Box 18.

- The amount of local taxes withheld goes in Box 19.

- Box 20 is for the specific name of the place that the local taxes are tied to.

Employees: How to Find Your W-2 Online and What to Do If It’s Missing

Employers typically send W-2 forms through the mail. It is also common for your employer to make your W-2 available online. If you visit your company’s online payment or HR system, there’s normally a tab for your tax forms, including your W-2.

As mentioned above, the law requires employers to send your W-2 by February 2. It may take a few days after that deadline for forms to appear online. You can also get a copy of your W-2 straight from the IRS.

If you’re missing a W-2 form or if you lose the form, be sure to contact your employer as soon as possible. If you don’t receive the forms by Valentine’s Day, it’s a good idea to give the IRS a call.

You will need your W-2 to complete your tax return. But, if worst comes to worst, you could fill out Form 4852 instead. This form serves as a substitute wage and tax statement if you did not receive or lost your W-2. You may also want to consider filing for an extension if you are unable to obtain all necessary forms by the end of February.

If you receive your W-2 later and it differs from the estimates you made on Form 4852, you can complete an additional form, Form 1040X, so your tax return is accurate. This is known as filing an amended tax return.

W-2 vs. 1099: Key Differences for Employers and Workers

Understanding the difference between W-2 and 1099 classifications is essential for both employers and workers. These two forms reflect fundamentally different work arrangements, each with its own tax reporting rules, legal responsibilities and financial implications.

Employment Classification

- A W-2 worker is a traditional employee. Employers are responsible for withholding income taxes, Social Security and Medicare taxes from their paychecks. W-2 employees may also receive benefits such as health insurance, paid time off and retirement plan contributions.

- A 1099 worker is typically an independent contractor. These individuals are self-employed and receive full payment without tax withholdings. They are responsible for reporting and paying their own self-employment taxes and estimated quarterly taxes to the IRS.

Tax Filing Responsibilities

- W-2 employees receive their tax documents directly from their employer and usually only file an individual tax return (Form 1040), using the W-2 as a supporting document.

- 1099 workers receive one or more Form 1099-NEC from clients who paid them $600 or more in the tax year. They may need to file Schedule C (Profit or Loss From Business) and Schedule SE (Self-Employment Tax) with their Form 1040.

Employer Obligations

- Employers must withhold and remit employment taxes for W-2 employees, file quarterly payroll reports and issue W-2s by the February 2 deadline.

- For 1099 workers, employers do not withhold taxes or offer employee benefits. However, they must report payments on Form 1099-NEC and send copies to both the contractor and the IRS by the required deadline.

Legal and Financial Risks

- Misclassifying a worker as a 1099 contractor when they should be treated as a W-2 employee can lead to penalties, back taxes and interest charges for employers. The IRS and Department of Labor may audit businesses to verify worker classification compliance.

How to Determine the Correct Classification

- Use the IRS’s Common Law Test, which evaluates the degree of control the business has over the worker. There are three main assessments.

- Behavioral: Does the company control how the worker does their job?

- Financial: Does the company control the business aspects, such as payment and reimbursement?

- Type of relationship: Are there benefits, contracts or expectations of ongoing work?

Employers unsure about proper classification can file Form SS-8 with the IRS to request a formal determination. It is critical that you get the classification correct so you can meet your tax obligations and avoid potential compliance issues.

Bottom Line

W-2 forms reveal how taxes affect employees’ annual earnings. For an employee, they show whether to expect a tax refund from paying more taxes than necessary. If you are an employee and your W-2 includes errors, you need to report that information to your boss as soon as possible. In some cases, like when your name on the form does not match the name on your Social Security card, you may need a new form.

Tax Season Tips

- Some financial advisors can help you create a tax strategy for your investments and overall estate. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area. You can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- You can do your taxes by hand, transferring info from your W-2 and other forms onto your Form 1040 according to the instructions. Or you could pay for a tax prep program to make it a little easier. Check out our roundup of various tax software to see which service might be best for you.

- If you don’t know whether you’re better off with the standard deduction versus itemized, you might want to read up on it and do some math. You could find that you’d save a significant amount of money one way or another. So it’s best to educate yourself before the tax return deadline.

Photo credit: ©iStock.com/ITkach, Image of 2018 W-2 Form comes from IRS.gov, ©iStock.com/Steve Debenport